A federal appeals court has halted new regulations designed to make it easier for borrowers defrauded by their school to receive student loan forgiveness.

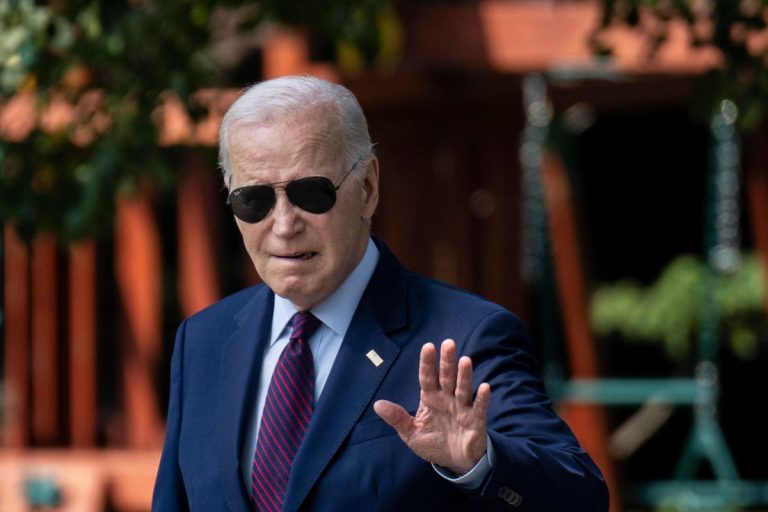

The Biden administration had implemented new regulations last month to expand access to student debt relief under a key federal discharge program for defrauded borrowers. But the future of the new rules is now uncertain.

Here’s the latest.

Student Loan Forgiveness Through Borrower Defense To Repayment

Borrower Defense to Repayment is a federal student debt relief program for borrowers who misled by their educational institution. If a school induces a student to enroll in a program through misrepresentations or lies about key aspects of the program — such as career prospects, earnings potential, admissions selectivity, or the transferability of credits — a borrower can potentially qualify for federal student loan forgiveness.

The Borrower Defense program has been the subject of numerous political and legal battles since a formal application process was first established under the Obama administration in the wake of several high-profile collapses of national for-profit college chains that were accused of widespread misconduct. Then, the Education Department under the Trump administration rewrote the Borrower Defense regulations and enacted new policies designed to limit student debt relief under the program. At the same time, hundreds of thousands of borrowers saw their requests for student loan forgiveness stalled or rejected, leading to a class action lawsuit that only recently settled.

The Biden administration rewrote the Borrower Defense regulations yet again, this time to broaden access to student debt relief under the program. The new rules, which went into effect on July 1, expanded the categories of school misconduct that can be the basis for Borrower Defense relief, relaxed time limits for submitting applications, and eased the process for the Education Department implementing relief for groups of similarly situated borrowers.

Appeals Court Halts Student Loan Forgiveness Under New Borrower Defense Rules

On Monday, a federal appeals court issued a nationwide injunction blocking implementation of the new Borrower Defense rules. The 5th Circuit Court of Appeals, viewed as one of the most conservative federal circuit courts in the country, said little of substance in its brief order, but appeared to agree with legal arguments made by a coalition of dozens of for-profit colleges that the schools could suffer irreparable harm as a result of the new Borrower Defense regulations. The coalition, represented by Career Education Colleges and Universities, had argued that the Biden administration had “overreached” and violated federal law in enacting the new rules.

Advocacy groups for borrowers were critical of the ruling. “This unexplained order from the Fifth Circuit is a gift to those who wish to operate predatory education schemes with impunity. Borrower defense is an essential safeguard that has been in place for decades. It is necessary to protect students from being scammed, and it ensures that predatory actions come to light and are stopped before they go on to harm even more students,” said Eileen Connor, President and Director of the Project on Predatory Student Lending in a statement. “These organized, well-funded political attempts to weaponize the court system against the legal rights of borrowers underscore how stacked the system is against our clients.”

“The decision by the appeals court to block Biden’s new student debt relief policy for defrauded borrowers is disappointing. For far too long, for-profit schools have exploited the system and deceived borrowers, leaving them in a crippling cycle of debt,” said Jaylon Herbin, director of federal campaigns at the Center for Responsible Lending in a statement. “Tens of thousands of student loan borrowers have been misled by their schools with false advertisements for job prospects or have been left in limbo once their school suddenly closed. The administration’s efforts to make debt relief more accessible, especially in cases of sudden school closures, are crucial for safeguarding the interests of students attending any type of school.”

Latest Student Loan Forgiveness Setback For Biden Administration

The brief order from the 5th Circuit Court of Appeals is not the final word on the new Borrower Defense regulations. The Court will consider additional legal arguments before making a final ruling on whether to permanently block the rules. But the issuance of the preliminary injunction strongly suggests that the Court is amenable to the schools’ arguments. The Biden administration indicated it is reviewing the order and will respond.

If the new regulations are ultimately struck down, the Borrower Defense program would remain intact. However, new Borrower Defense applications would not be reviewed under the new, more generous regulations. Instead, they would be subject to the prior set of regulations that were established under the Trump administration.

The ruling is just the latest legal setback for the Biden administration in its attempts to provide broad student debt relief to borrowers. Last week, conservative legal groups filed a lawsuit to block student loan forgiveness for over 800,000 borrowers under the IDR Account Adjustment. And in June, the Supreme Court struck down Biden’s mass student loan forgiveness plan that would have cancelled $10,000 or more for millions of borrowers.

Further Student Loan Forgiveness Reading

Could New Lawsuit Reverse Biden’s Latest Student Loan Forgiveness Approvals?

Student Loan Forgiveness Just Got Easier For These Borrowers

5 Student Loan Forgiveness Updates As Payments Resume In A Matter Of Weeks

Here’s When The Next Student Loan Forgiveness Notifications Will Go Out

Read the full article here