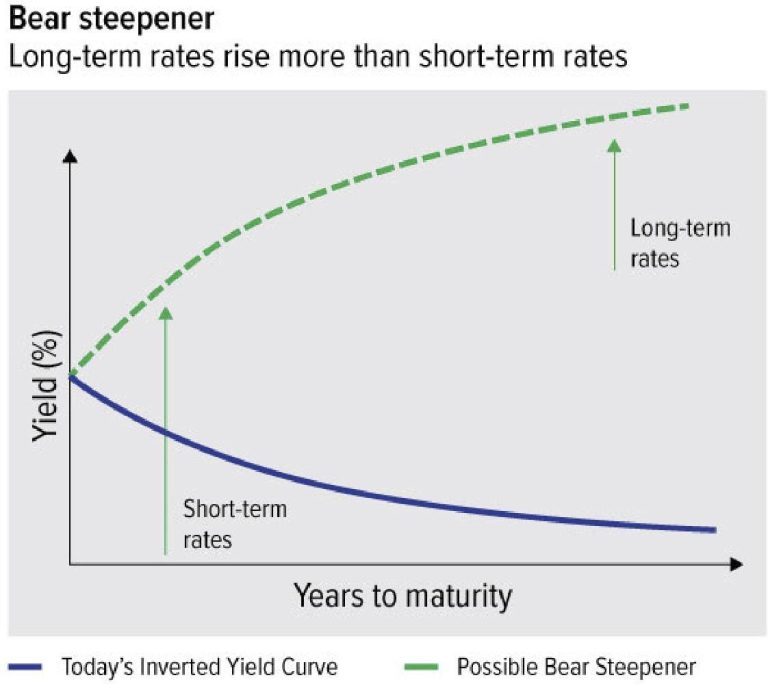

In my last missive (The Stock Market Loves Bidenomics (So Far) (forbes.com)), we pointed out a rare policy called “fiscal dominance”. Now we may have spotted another rare bird. Let’s start with a yield curve primer: The yield curve maps out interest rates (we care in this case about US Government) all the way from 3 months to 30 years. Usually, as in 90% of the time, shorter rates are lower than longer interest rates (by about 1% or more). Bond gurus call this a steep yield curve. Makes sense because a bond holder should be compensated to hold for a longer term. Occasionally, like now and since 2022, short interest rates are higher than long ones; this we call an inverted curve. Simplistically, there are two ways a yield curve can steepen: short-term interest rates go down faster than long-term rates or long-term rates go up faster than short-term rates. The latter journey is the “bear steepener”.

Protracted bear steepeners – ones that last more than a few days and move more than a few basis points – are a rare sighting in one’s career. Yet understanding how to spot one, why they occur, and what they mean for other asset classes is important. Historically, there are many times the yield curve is steepening. But is rare to get a bear steepener once the curve has become inverted. Since 1976, let’s point out the times where the curve bear steepened after it was in an inverted shape: 1980-82, 1990, 2001, 2007, and 2020. That is a royal flush of recession warnings, ugh!

Typically bear steepeners spell chaos for all parts of a portfolio because they typically coincide with tightening financial conditions and higher real yields. Very similar to what we saw this week with yields up, stocks, credit, commodities down, the higher risk-free rate makes all other assets discount rates reprice higher and can even push an economy into recession if severe enough.

Over the last several trading days we have witnessed what could be the beginning of a bear steepening of the yield curve, with the 30-year government bond yield rising 30 basis point and the 2-year government bond yield falling 2 basis points from the beginning of the month.

There are several plausible reasons why this type of steepening is happening now. First, the yield curve on all traditional measures (2s10s, 2s30s, 3m10s) is extremely inverted, and one would have go back to the early 1980s Volker era to find an analogous period. Given that the most recent hard economic data, which we can measure with the Citi Economic Surprise Hard Data Index, is proving to be better than expected, and the Fed still hasn’t declared victory on inflation yet, lending long versus. the front end is a negative carry trade for investors.

Second, considering the soaring budget deficit and the resulting incremental issuance of government bond supply hitting the market over the coming months and quarters, there is even less incentive for buyers to show up at the lower yields of longer dated bonds, when they can earn over 100 bps more for zero risk on the front of the curve.

Third, a traditional large buyer of government bonds – banks – are not showing up to scoop up government bonds like normal, given the recent challenges to their deposit base, and their assets already under pressure from interest rates rising the last two years. This leaves foreigners, asset managers and other traditional investors as the marginal buyers of US debt, and they all want to be properly compensated for these risks.

Fourth, with the recent renewed strength of commodities, particularly energy commodities, fears of renewed inflationary pressures are beginning to show. Longer dated breakeven inflation rates, a measure the Fed pays attention to assess inflation sentiment in the market, have risen about 20 bps in recent days, most likely stoking fears of investors holding debt on an already deeply inverted yield curve.

Unfortunately, predicting how and when the yield curve steepens is tough but looking at how much the yield curve is inverted, a steepening is a certainty. With all these potential reasons for a bear steepening right now, what are the options to mitigate risk? For starters, investors can avoid long duration assets that are sensitive to interest rates. This means long dated bonds and high-valuation growth equity. The front of the treasury curve is paying patient investors 5.50% to sit and wait for longer dated yields to rise some more, or alternatively for the Fed to bring short-dated rates down. A lot of pro investors will also put on duration-neutral curve steepeners, which entails buying and shorting different points of the yield curve simultaneously in unequal dollar amounts to neutralize the interest rate risk. This trade has the benefit of being right two ways: Either the Fed cuts rates sooner or later, promoting a bull steepening, or the bear steepening continues and the long duration shorts make money.

Keeping your eyes peeled for these rarely-seen macroeconomic birds and risk managing them is a key part of smooth-ride investing.

Read the full article here