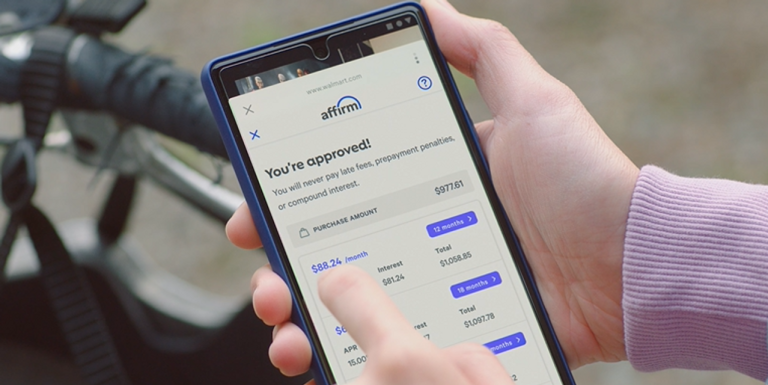

Affirm Holdings Inc. shares were powering nearly 7% higher in Thursday’s after-hours action after the buy-now-pay-later operator topped expectations with its latest results.

The company posted a net loss of $206.0 million, or 69 cents a share, compared with $186.4 million, or 65 cents a share, in the year-earlier period. The FactSet consensus was for an 87-cent loss per share.

Affirm’s

AFRM,

revenue rose to $446 million from $364 million, whereas analysts were looking for $406 million.

“Despite significant changes in interest rates and consumer demand, we still delivered good credit results, unit economics and [gross merchandise volume] growth,” Chief Financial Officer Michael Linford said in a release. “We also demonstrated that the business can continue to expand profitably even in a high interest-rate environment.”

The company recorded $5.5 billion in GMV, up from $4.4 billion a year before, while the FactSet consensus was for $5.3 billion. GMV represents the dollar amount of transactions flowing through Affirm’s platform.

“Examples of impactful launches this quarter include down payment-sensitive APRs [annual percentage rates] to help consumers make smarter financial decisions, campaigns to increase adoption of repayment from bank accounts via ACH [automated clearing house], servicing tools, and as always, checkout optimization,” Chief Executive Max Levchin said in the letter. “Several projects to improve conversion shipped and are expected to add over $600 million of annualized GMV.”

Revenue less transaction costs, a metric that the company says measures the economic value of the transactions it processes, fell to $182.1 million from $184.2 million a year before. RLTC was 3.3% of GMV.

The company disclosed that it’s been adding about 75,000 active cardholders each month for its debit-card product, and it had over 300,000 active cardholders as of mid-August.

For the fiscal first quarter, Affirm expects $5.30 billion to $5.50 billion in GMV, along with $430 million to $455 million in revenue. Analysts had been looking for $5.39 billion in GMV and revenue of $430 million.

Read the full article here