The Biden administration is proceeding with steps to establish a new student loan forgiveness program to replace the one struck down by the Supreme Court earlier this summer. Top officials have suggested that they want the new plan to cover as many borrowers as possible.

The Education Department has been vague so far about what the new student loan forgiveness plan will look like, and when it will become available. But last week, the administration released an outline of next steps and a partial projected timeline as officials work to develop the new program.

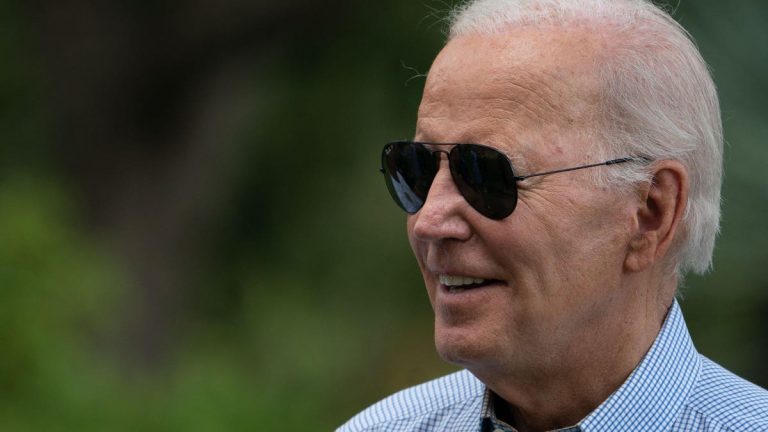

Biden’s Student Loan Forgiveness Backup Plan

President Biden’s initial student loan forgiveness plan would have cancelled $10,000 (or up to $20,000 in some cases) for over 30 million federal student loan borrowers. That plan was enacted under the HEROES Act of 2003, a 20-year-old federal statute whereby Congress delegated authority to the Education Department to broadly “modify” or “waive” rules governing federal student loan programs in response to economic harm experienced by borrowers due to a national emergency.

But the Supreme Court struck down Biden’s sweeping student debt relief plan in June. Chief Justice John Roberts, writing for the conservative majority, concluded that the program was not authorized by Congress because such massive federal student loan forgiveness (which observers estimated could cost over $400 billion) was not expressly permitted by the HEROES Act’s broadly-worded statutory text.

Within weeks of the Supreme Court ruling, the Biden administration initiated a process to establish a “Plan B” for mass student loan forgiveness. Rather than relying on the HEROES Act, Biden indicated that the new plan would be enacted through the Higher Education Act, an entirely distinct statute. The HEA contains a provision that allows the Education Department to “compromise” or “waive” federal student debt obligations in certain circumstances. While the HEROES Act’s waiver authority was untested, the so-called “compromise and settlement” authority under the HEA has already been utilized under a variety of circumstances across multiple administrations, albeit not on the scale of Biden’s initial student loan forgiveness plan.

But unlike the HEROES Act, the HEA requires that the Education Department go through a lengthy and complicated procedure called negotiated rulemaking to establish new regulations governing HEA programs. The department must first create a rulemaking committee comprised of key stakeholders. And that committee must then hold a series of public hearings and consider public input before drafting, finalizing, and enacting new regulations. The process typically takes many months.

Education Department Releases Details and Timeline For New Student Loan Forgiveness Rulemaking

Last week, the Biden administration announced key milestones and an anticipated timeline for the negotiated rulemaking process required to create the new student loan forgiveness plan.

First, the Education Department announced the initial formation of the negotiated rulemaking committee. Department officials will consider nominations to the committee, which contains spots designated for key stakeholders including current students, student loan borrowers, colleges and universities, state officials, veterans, and civil rights groups.

Second, the department announced a proposed schedule of public hearings, during which the negotiated rulemaking committee will consider the parameters of the new student loan forgiveness plan. The hearings will take place virtually on October 10-11, November 6-7, and December 11-12. The public will have the opportunity to participate and comment, according to a department announcement.

Once the hearings have been completed, the Biden administration will publish draft regulations, which will again afford the public with the opportunity to provide comments and feedback before the plan is finalized.

When Will Biden’s New Student Loan Forgiveness Program Be Available?

While last week’s announcement provides key new details about the process for establishing the new student loan forgiveness plan, it will not be clear for quite some time exactly when the new program will be finalized and available for borrowers.

Dozens of House and Senate Democrats wrote to the administration in August, urging President Biden to enact the new student debt relief plan by this winter.

“We appreciate your announcement initiating a rulemaking under the Higher Education Act of 1965 to deliver on debt relief and write to urge you to swiftly carry out your commitment to working- and middle-class families, and cancel student debt by early 2024,” wrote the lawmakers.

However, early next year may be an ambitious timetable. Typically, negotiated rulemaking results in the establishment of new regulations that go live in July. So it may not be until next summer that the new student loan forgiveness program is available.

Education Department Urges Borrowers To Make Payments While Student Loan Forgiveness Process Continues

While the Biden administration moves forward to establish the new student loan forgiveness plan, 40 million borrowers are facing the imminent return to repayment. The student loan pause officially ended last week, and student loan payments are set to resume in October.

“We are developing a new debt relief program through a process called negotiated rulemaking. This process will take time, and you will be required to make payments in the meantime,” says the Education Department in guidance to borrowers. “When designing a new debt relief program, we will consider ways to ensure that borrowers making payments maintain their eligibility for debt relief.”

In the meantime, the Biden administration is implementing a 12-month on-ramp period following the return to repayment.

“To help borrowers successfully return to repayment, we created a temporary on-ramp period through Sept. 30, 2024. This on-ramp period protects borrowers from having a delinquency reported to credit reporting agencies. This prevents the worst consequences of missed, late, or partial payments,” says the department. “However, payments are still due, and interest will continue to accrue (add up). We will not report you as delinquent during the on-ramp, but we do not control how credit scoring companies factor in missed or delayed payments.”

Further Student Loan Forgiveness Reading

Critical Day For Student Loan Borrowers Is Here — 4 Key Details

Biden Administration Announces $72 Million In Student Loan Forgiveness

Student Loan Forgiveness Update: What The Latest Court Victory Means For Borrowers

There’s Still Time To Qualify For Student Loan Forgiveness Under Adjustment

Read the full article here