Washington D.C., Denver and Raleigh, North Carolina, are the real estate markets that are projected to see the most substantial changes as the Federal Reserve begins to lower borrowing rates.

According to a new Realtor.com report published Tuesday, markets with a high percentage of homeowners with a mortgage stand to see the most changes.

In Washington and Denver, for instance, almost 75% of owner-occupied homes have a mortgage.

But the effect of lower mortgage rates will differ depending on mortgage usage and homeowners in these areas, according to the real estate firm.

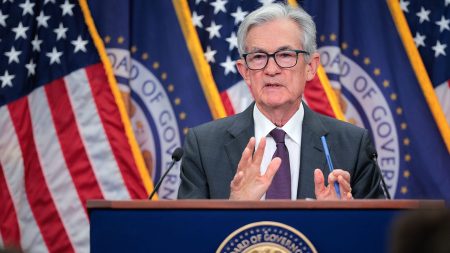

FEDERAL RESERVE CUTS INTEREST RATES BY HALF-POINT; FIRST RATE REDUCTION IN FOUR YEARS

Two other markets, Virginia Beach, Virginia, and Portland, Oregon, might also be “more sensitive to the impact of lower rates” due to the high utilization of mortgages, according to the report.

The Federal Reserve cut interest rates in September for the first time in four years. Realtor.com economists now project that mortgage rates will remain in the low 6% range through the end of 2024, with expectations for a further decline to the high 5% range by next spring. This decrease could stimulate borrowing and homebuying activity as more buyers re-enter the market.

THESE FIVE CITIES HAVE THE HIGHEST RENT FOR ONE-BEDROOM APARTMENTS

Realtor.com chief economist Danielle Hale said changes in market rates are likely to factor into buying and selling decisions for more homeowners in the aforementioned markets due to the high share of homeowners with mortgages.

However, Hale also noted that the market rates still exceed the rates that most homeowners have locked in, keeping them in “golden handcuffs.”

Here are the metros with the highest share of homes with a mortgage. These metros will see the most changes, according to Realtor.com:

- Washington-Arlington-Alexandria, D.C. – 74.7%

- Denver-Aurora-Lakewood, Colorado – 72.4%

- Raleigh-Cary, North Carolina – 72%

- Virginia Beach-Norfolk-Newport News, Virginia-North Carolina – 71%

- Portland-Vancouver-Hillsboro, Oregon-Washington – 69.8%

- Baltimore-Columbia-Towson, Maryland – 69.5%

- Seattle-Tacoma-Bellevue, Washington – 69.4%

- Atlanta-Sandy Springs-Alpharetta, Georgia – 69.4%

- Indianapolis-Carmel-Anderson, Indiana – 69.0%

- San Diego-Chula Vista-Carlsbad, California – 68.9%

These markets are projected to have the least amount of impact given the higher share of outright ownership:

Metros with the highest share of homes without a mortgage:

- New Orleans-Metairie, Louisiana – 45.8%

- Buffalo-Cheektowaga, New York – 45.2%

- Pittsburgh, Pennsylvania – 45.2%

- Miami-Fort Lauderdale-Pompano Beach, Florida – 43.8%

- Tampa-St. Petersburg-Clearwater, Florida – 42.9%

- Detroit-Warren-Dearborn, Michigan – 41.7%

- Birmingham-Hoover, Alabama – 41.5%

- Houston-The Woodlands-Sugar Land, Texas – 41.2%

- Oklahoma City, Oklahoma – 41%

- Cleveland-Elyria, Ohio – 40.5%

Read the full article here