Contracts to buy previously owned homes fell to a record low in January as prospective buyers were constrained by higher mortgage rates and house prices.

The National Association of Realtors (NAR) said on Thursday that its Pending Home Sales Index, which is based on signed contracts, declined by 4.6% last month to 70.6, an all-time low.

Economists polled by Reuters had forecast contracts, which become sales after a month or two, falling by 1.3% in January. Pending home sales were down 5.2% from a year ago.

“It is unclear if the coldest January in 25 years contributed to fewer buyers in the market, and if so, expect greater sales activity in the upcoming months,” said NAR chief economist Lawrence Yun. “However, it’s evident that elevated home prices and higher mortgages strained affordability.”

MORTGAGE RATES FALL FOR FIFTH WEEK IN A ROW, HOVER NEAR 7%

Mortgage rates ranged from 6.91% to 7.04% in January and NAR noted that in comparison to one year ago, the monthly mortgage payment on a $300,000 home increased by an extra $50 to $1,590. Mortgage rates have since declined slightly in February to about 6.85%.

Around the country, the number of signed contracts fell in the Midwest, South and West, but rose slightly in the Northeast.

“Even a slight reduction in mortgage rates will likely ignite buyer interest, given rising incomes, increased jobs and more inventory choices,” Yun added.

EXISTING HOME SALES FALL TO LOWEST LEVEL IN NEARLY 30 YEARS

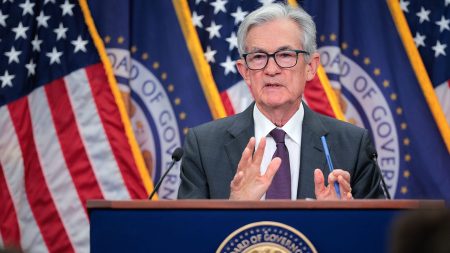

Mortgage rates have remained elevated even as the Federal Reserve cut its benchmark interest rate by 100 basis points since September.

The central bank has since paused the rate cuts in January while it weighs the impact of the Trump administration’s policies on inflation, as tariffs, tax cuts and mass deportations of illegal immigrants are viewed by economists as potentially spurring inflation.

Mortgage rates track the yield on the 10-year Treasury note, which has dropped in recent days amid softer economic data. However, concerns about inflation will likely limit the scope of the decline, while consumers’ inflation expectations have risen on fears that tariffs will increase the price of goods.

Reuters contributed to this report.

Read the full article here