If you’ve ever looked at your bank account and thought, “Where did it all go?” you’re not alone. With prices rising on everything from groceries to gas, managing money can feel like a full-time job. But here’s the good news: you don’t need to be a finance expert or complicated spreadsheets to take control. There’s a new wave of financial tools designed to help everyday people save smarter, invest better, and stress less. We’ve rounded up some of the best lesser-known options that actually make a difference.

What You Need to Know About Our Review Process

Before we hop into our list, you should know that everything we suggest here at Saving Advice has been thoroughly researched. When it comes to your money, we don’t play around. It’s important to know that the app or tool you are using is safe and reputable. We go through consumer reviews, check out the apps/sites ourselves, and ensure we are really putting the best financial tools in front of you.

That said, depending on what your financial goals are, there should be something for you on this list. If you decide to sign up or purchase anything through the links in this article, we may receive compensation. It helps us keep the show on the road here at Saving Advice. But you’re also gaining access to some of the absolute best tools available. So, it’s a win-win.

Now that that’s out of the way, here are six of the best financial tools around. They can help you reach your financial goals in 2026 and beyond.

1. Albert – The App That Does the Thinking for You

Albert is like having a financial assistant who never sleeps. It automatically analyzes your spending, helps you save without thinking, and even offers real-time advice from actual experts. You don’t need spreadsheets or calculators. Just link your accounts and let Albert work its magic. It’s perfect for anyone who wants to build savings without changing their lifestyle.

Pros

- Get budgeting, spending, and saving data all in one place.

- Bank-grade encryption and FDIC insurance.

- It’s easy to navigate.

- You can get cash advances, which can be helpful when an unexpected expense comes up.

Cons

- The free version of the app is fairly limited. Paid subscriptions are also a little pricey, with subscriptions landing between $14.99 and $39.99.

- Its savings account is not all that great. It doesn’t earn interest, and when compared to the plethora of high-yield savings accounts out there, that’s not ideal.

Overall verdict: But you may want to proceed with caution with this one. Many reviews online point to some sketchy business practices. Cancellation seems to be “nearly impossible.” Some users have also reported that the app has taken money from their accounts without authorization. However, others have found it “helpful” and a “godsend.”

2. SuperMoney – Compare Loans, Credit Cards & More in One Place

Ever feel overwhelmed trying to find the best loan or credit card? SuperMoney makes it easy by letting you compare offers side-by-side with no fine print surprises. Whether you’re refinancing a personal loan or looking for a better credit card, SuperMoney gives you the tools to make smart choices. It’s especially helpful for older adults who want transparency and control.

Pros

- SuperMoney has a 4.6-star rating on TrustPilot. Most people have a positive experience with the site.

- Many people find it helpful and easy to use, calling it a “one-stop shop” for comparing their financial options.

- It’s a safe and reputable platform that you can trust.

Cons

- SuperMoney’s name has been known to be used by scammers. So, it’s important that you’re careful to make sure you’re dealing with the real thing. Only sign up using the official website.

- Some people have had complaints about customer service, but they seem to be few and far between.

Overall verdict: People seem to really love SuperMoney. It makes things easy if you are in the market for a loan or a new credit card. You can see everything in one place and get a good idea of the interest rates you’ll be looking at.

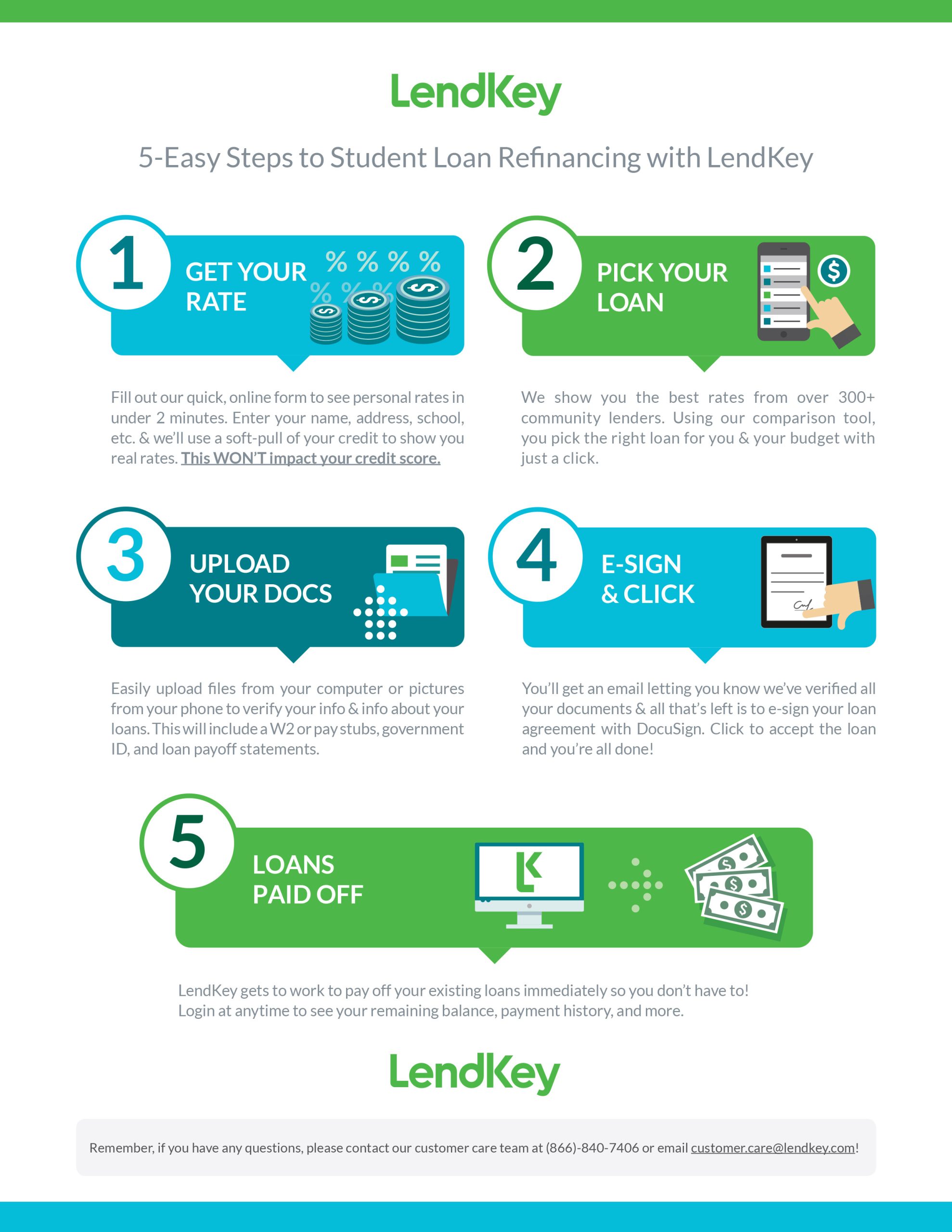

3. LendKey – Student Loan Help That Actually Helps

Still paying off student loans or helping your kids or grandkids with theirs? LendKey connects you with community banks and credit unions offering competitive refinancing options. You can compare rates, lower your payments, and even shorten your loan term. It’s a smart move for anyone looking to lighten the load.

Pros

- You can get access to lower interest rates through non-profit lenders that you wouldn’t find anywhere else.

- The application process is simple.

- Many people praise the customer service for being responsive.

- There are some repayment assistance options available for individuals who are going through financial hardship.

- Most of the lenders on the platform don’t charge application, origination, or prepayment penalties.

Cons

- Terms for cosigner release depend on the specific partner lender, and some users have reported difficulties in obtaining a release even after meeting stated terms.

- A small number of complaints mentioned issues with payment processing times and understanding how payments were applied to the loan.

- Refinancing federal student loans into a private loan through LendKey means losing access to federal benefits like income-driven repayment plans and loan forgiveness programs.

- LendKey does not disclose a minimum required credit score, but borrowers generally need a strong credit history and an income of at least $24,000, or a qualified cosigner, to be approved for the best rates.

Overall verdict: LendKey has a 5-star rating with the Better Business Bureau and a 4.1-star rating with Trustpilot. It is an incredibly reliable source for finding lenders with better rates to refinance your student loans. If you’re someone who would benefit from having all of your student loans consolidated into one or who would benefit from a better rate, this a a great option.

4. The Motley Fool Stock Advisor – Invest Without the Guesswork

If you’ve ever wanted to invest but didn’t know where to start, The Motley Fool Stock Advisor is a great first step. You get expert stock picks, market insights, and a proven strategy for long-term growth. It’s ideal for older investors who want to build wealth without constantly watching the market.

Pros

- The Motley Fool is a trusted name in personal finance.

- They frequently provide stock picks that contribute to long-term portfolio growth.

- The Fool’s website states that the advisor has an average stock pick return of over 865%. That’s insane!

Cons

- In reviews, some people have noted that The Motley Fool frequently suggests buying stock when they are at a high.

- Some people believe the content in Stock Advisor newsletters leaves something to be desired.

- Many people have complained about the “spammy” emails they get daily.

Overall verdict: The Motley Fool is a name you can trust, but people have some reservations about the subscription. There also seems to be a fair amount of upselling and marketing pitches tied to the service. It has received a 3.1-star rating on Trustpilot, with some people complaining that it was difficult to reach anyone about their subscription. That said, if you’re looking for good returns, The Fool’s Stock Advisor has a proven track record.

Best of all? You can join now for 50% off.

5. Lunch Money – Budgeting That Doesn’t Feel Like a Chore

Lunch Money is a sleek, customizable budgeting app that makes tracking expenses feel less like homework. You can set goals, monitor spending, and even track your net worth. It’s great for people who want clarity without clutter.

Pros

- Many people have found Lunch Money’s app to be extremely helpful after Mint shut down.

- It’s relatively affordable when compared to other similar apps. Annual subscriptions can be as low as $100 or $10 per month.

- An independent developer makes it easier to reach out for customer service.

- The app handles multiple currencies, which can be helpful for users with international finances.

Cons

- The web-based version is a little better equipped than the app.

- Some people have expressed a desire for better savings tracking on the site/app.

- Users have occasionally experienced delays in bank account updates.

Overall verdict: Because Lunch Money is still so new, there aren’t any Trustpilot or BBB reviews to speak of at this time. But you can see what people are saying in Google Play and the App Store, and it’s all mostly positive, with a 4.5 and 4.4-star rating (respectively). Some people say it’s exactly what they’ve been looking for since Mint shut down.

6. MyBudgetCoach – Personalized Help for Real-Life Budgets

Sometimes you need more than an app. You need a coach. MyBudgetCoach offers personalized guidance to help you build and stick to a budget. It’s especially useful for people adjusting to fixed incomes or planning for retirement.

Pros

- You can get personalized coaching based on your finances and your goals.

- Users are able to learn how to budget using the zero-based budgeting method, which many people find effective.

- A lot of people have reported feeling more in control of their finances after using MyBudgetCoach.

- Automation makes it really easy to track your expenses and see where every dollar is going.

Cons

- The app is definitely better positioned to help people who need a little more guidance.

- While the app is $14.99 for the basic level, you’ll have to pay more if you want one-on-one help from a coach. You will pay $34.99+ per hour for a one-on-one call, and prices vary based on the coach.

- Some people are turned off by the price. There are some cheaper options out there.

- It still lacks the functionality of some of the other leading budgeting apps.

Overall verdict: When compared to similar services like You Need A Budget (YNAB), MyBudgetCoach is pretty good. It’s simple and straightforward. Although they are still working on some things, many people find it worth a try.

Quick Comparison: Who Benefits From These Tools?

| Tool | Key Benefit | Best For |

|---|---|---|

| Albert | Automated savings and real-time financial advice | People who want hands-off money management |

| SuperMoney | Side-by-side comparison of loans, credit cards, and financial products | Savvy shoppers looking for the best rates |

| LendKey | Student loan refinancing with community banks and credit unions | Borrowers seeking lower payments or better terms |

| Motley Fool Stock Advisor | Expert stock picks and long-term investment guidance | Beginners and long-term investors |

| Lunch Money | Clean, customizable budgeting interface | Budgeters who want clarity without clutter |

| MyBudgetCoach | Personalized budgeting help and accountability | Users adjusting to fixed income or retirement |

You Don’t Need to Be Rich to Be Smart With Money

The truth is, most people aren’t looking to get rich overnight. They just want to feel in control. These financial tools are designed to help you do exactly that, without stress or confusion. Whether you’re saving for retirement, paying off debt, or just trying to stretch your dollars, there’s a tool here that can help. The key is to start small and stay consistent. Your future self will thank you.

What to Read Next

Read the full article here