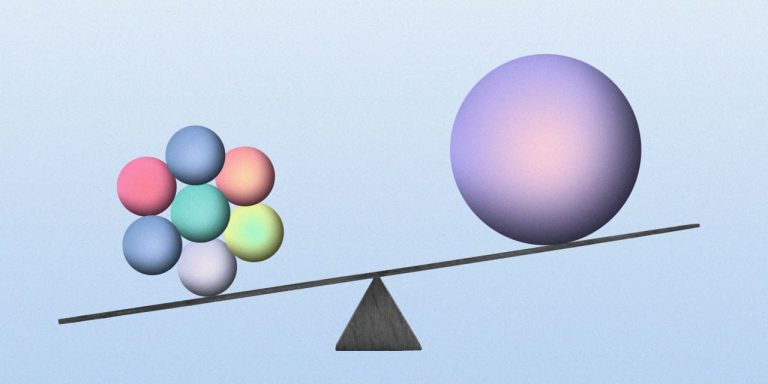

It’s a lopsided world. Stock markets are a seesaw with the so-called Magnificent Seven on one side and everything else on the other side. That presents a “once in a generation opportunity” in everything except those companies, says Richard Bernstein Advisors.

The seven big tech firms—

Apple

(ticker: AAPL),

Amazon.com

(AMZN), Google parent

Alphabet

(GOOGL),

Facebook

parent Meta Platforms (META),

Microsoft

(MSFT),

Nvidia

(NVDA), and

Tesla

(TSLA)—have played an outsize role in this year’s stock market rally. The

S&P 500

(SPX) has delivered total returns of more than 13% this year, but If you remove the shares of the seven, the index is about flat.

Most investors favor the high side of the seesaw with the seven stocks, RBA said in a recent note. The firm’s portfolios, however, “are squarely positioned” on the other side.

“People like the seven stocks simply because the stocks are going up, not that there’s any fundamental reason behind them,” Richard Bernstein, RBA’s CEO and chief investment officer, told Barron’s. “That says that there’s got to be opportunities elsewhere.”

He said people laugh when he quips that he likes everything that’s not the Magnificent Seven, adding: “That’s not quite true, but it’s not that far off.”

Bernstein said the firm’s research shows that narrow markets are economically justified when growth is scarce, such as during a profits recession, because investors gravitate toward the fewer companies that can produce substantial growth. The narrow leadership of the Magnificent Seven could be justified if growth was very scarce. The problem is that it isn’t.

In fact, corporate profits are accelerating and the overall economy looks set to remain quite healthy, according to RBA, which manages more than $15 billion using global macro-based strategies and investing primarily in exchange-traded funds.

Its ETF strategies are available at several of the larger broker-dealer platforms and aren’t sold directly to retail investors.

RBA screened U.S. companies for those with earnings growth of 25% or more. More than 130 companies passed the screen, but only one was from the group of Magnificent Seven and ranked 111th.

That suggests “there is nothing particularly magnificent about the Magnificent Seven,” the firm said. “Such narrow leadership seems totally unjustified and their extreme valuations suggest a once-in-a-generation opportunity in virtually anything other than those seven stocks.”

The Magnificent Seven are trading at an average price-to-earnings ratio of 41, compared with the equal-weighted S&P 500’s P/E of 15, according to RBA.

“There have been many studies that show long-term returns are a function of valuation,” said Bernstein. “I always point out to people, it’s probably not a good idea to go through life paying Bentley prices for Volkswagens.”

The big seven tech stocks are expensive relative to smaller cap stocks, the rest of the world, and emerging markets. “No matter how you want to slice and dice it, everything in the world is cheaper than these seven stocks,” he added. “It’s starting to argue that we could be looking at a lost decade in equities because the seven stocks are such a dramatic proportion of the index.”

RBA’s flagship strategy is the $7.1 billion Global Risk-Balanced Moderate ETF Strategy, which uses a blended benchmark that includes the MSCI ACWI Index for the stock portfolio.

It is overweight non-tech cyclical stocks, including industrials, energy, and materials.

“The profit cycle by definition is determined by cyclicals,” said Bernstein. “Stable growth is too stable. So if the profit cycle is slowing down, you don’t want to have cyclical exposure. If the profit cycle is heating up, you do.”

The biggest overweight is non-U. S. stocks, said Bernstein, who likes Canada, China, Europe, and Japan. “We think there’s a lot of opportunity in many parts of the world because profitability is starting to rev up and if you’ve got cheap assets and everybody hates them and profitability is starting to rev up, that’s a great story.”

Write to Lauren Foster at [email protected]

Read the full article here