Though there have been signs recently that the US and world economy are slowing, and broader inflation figures may have peaked, energy prices – particularly oil – are surging. This has a multitude of effects on the domestic and international economy. In the US, consumers continue to be squeezed on rent, food, and energy prices. Internationally, higher oil prices are contributing to an already dour outlook for global growth.

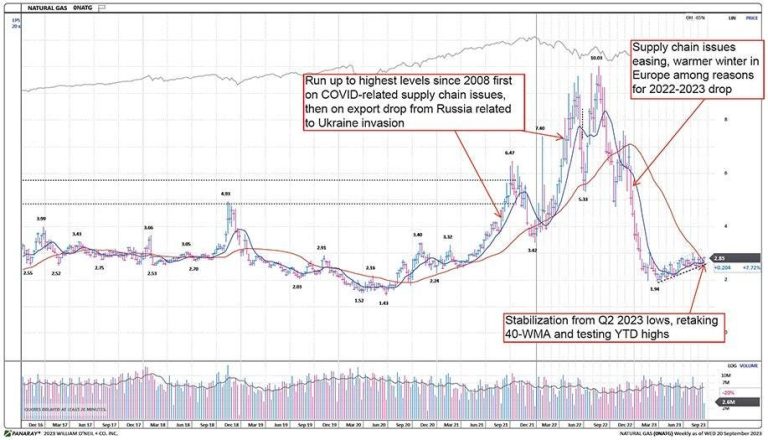

While not as dramatic as oil, natural gas prices, which have been a drag on the energy production segment for most of the year, have stabilized recently and begun to move higher. As seen on the Datagraph™ below, the price of natural gas has started to rise after bottoming earlier in the year. If prices rise further from here, this could have a detrimental impact on consumer spending during the winter heating months.

West Texas Intermediate oil prices have made YTD highs over the past couple of weeks, running up to test the Q4 2022 peak near $94/barrel (Figure 2). From here, some consolidation is likely and we would expect the mid-$80s (the April 2023 peak) as support in the event of a pullback. However, it appears that the low prices from this year’s June and July period are unlikely to recur soon.

Overall, global demand has been relatively stable. However, given the recent OPEC production cuts led by Saudi Arabia, current demand forecasts for 2023 and 2024 are expected to outpace supply. Specifically, the Saudis reduced their oil production by one million barrels per day (BPD) in July 2023. This was followed by Russia lowering its exports by 500,000 BPD in August and by 300,000 in September. The September cut is anticipated to remain for the rest of 2023. Since mid-2022 OPEC has reduced its production in aggregate by roughly two million BPD. While some of these cuts have been offset by increased production of non-OPEC producers, the net effect is still more than one million BPD of less supply since the start of 2023.

The OPEC charts below (Figure 3 and 4) shows that demand is forecast to be relatively robust at 2.4% y/y in 2023 and 2.2% y/y in 2024. This contrasts with a decline in oil production since the summer 2022 peak. As a result, it is probable that oil could trade in the $80–100 range in the near term. Such a result would be negative for the US consumer and the world economy at large.

Interestingly, as seen in the O’Neil chart (Figure 5), US government bond yields and oil prices have tended to rise and fall together over the last several years. With recent Fed tightening and commentary, that is occurring again right now. This combination of higher energy costs and higher debt and mortgage costs for the US consumer could create the long-anticipated recession many investors have been calling for.

In terms of stock performance, Energy stock prices have followed the commodities higher. For broad exposure, we suggest the largest Energy ETF, the SPDR S&P Energy (XLE

XLE

XOP

On the other side of the Energy sector spectrum is clean energy. For ETFs, we like the First Trust Nasdaq Clean Green Energy (QCLN), shown in Figure 8. This has solar, wind, hydrogen product makers and producers as well as electric vehicle makers and components suppliers. Clean energy has been a favored theme for some time at O’Neil. However, since September of 2022, the clean energy area has been among the worst segments in the market. Higher rates and slower residential solar demand are among the fundamental issues confronting the underlying stocks.

With regards to emerging clean energy technologies versus fossil fuels, oil and natural gas have the clear relative lead over the past year. In fact, the spread is approaching extreme levels. However, at O’Neil Global Advisors, we are trend followers. As such, we would not use this as a conclusive signal to buy until clean energy begins to turn the other way. In addition, while the current spread is large, it has been more extreme in recent years as seen Figure 9.

In conclusion, while the global macro-economic outlook remains muted, energy prices have been advancing due to supply cuts in oil and a bottoming of natural gas prices. O’Neil Global Advisors normally favors growth stocks, but we feel energy prices could remain elevated for the time being. As a result, we believe it is prudent for investors to have some exposure to the space. Several of the liquid ETFs mentioned here offer investors an easy way to participate.

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Company, an affiliate of O’Neil Global Advisors, made significant contributions to the data compilation, analysis, and writing for this article.

Disclosures

No part of the authors’ compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed herein. O’Neil Global Advisors, its affiliates, and/or their respective officers, directors, or employees may have interests, or long or short positions, and may at any time make purchases or sales as a principal or agent of the securities referred to herein.

O’Neil Global Advisors, Inc. (OGA) is an SEC Registered Investment Advisor. Information relating to investments in entities managed by OGA is not available to the general public. Under no circumstances should any information presented in this report be construed as an offer to sell, or solicitation of any offer to purchase, any securities or other investments. No information contained herein constitutes a recommendation to buy or sell investment instruments or other assets, nor to effect any transaction, or to conclude any legal act of any kind whatsoever in any jurisdiction in which such offer or recommendation would be unlawful. The past performance of any investment strategy discussed in this report should not be viewed as an indication or guarantee of future performance. Nothing contained herein constitutes financial, legal, tax or other advice, nor should any investment or any other decision(s) be made solely on the information set out herein.

© 2023, O’Neil Global Advisors Inc. All Rights Reserved. No part of this material may be copied or duplicated in any form by any means or redistributed without the prior written consent of OGA.

Read the full article here