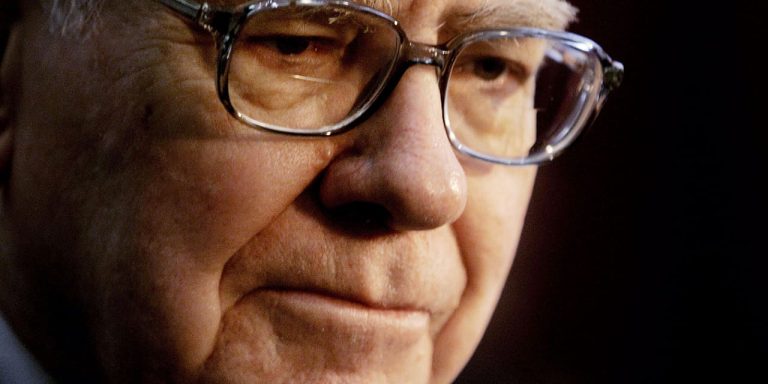

Berkshire Hathaway probably suffered a loss in the third quarter because of the impact of the stock market’s decline on its big equity portfolio, but Warren Buffett’s company should deliver stronger operating earnings.

Berkshire Hathaway (ticker BRK/A, BRK/B) will report its results on Saturday at 8 a.m. ET. It is one of the few companies to release its quarterly earnings on the weekend, reflecting CEO Buffett’s view that investors should have time to digest them before trading starts on Monday.

Operating profits, excluding unrealized losses in the equity portfolio and other investment results, are expected to show a gain of about 23% in the third quarter to $6,540 for a class A share, according to

FactSet.

That would mean about $9.5 billion of operating income after taxes.

The increase in operating profits for the quarter could have been driven by higher rates lifting interest income on Berkshire’s cash balance of nearly $150 billion, which is invested mostly in Treasury bills now yielding over 5%.

Investors also pay attention to Berkshire’s stock repurchases as an indication of Buffett’s view on the appeal of the shares.

Second-quarter repurchases were low at $1.4 billion, down from $4.4 billion in the first quarter. Berkshire bought back about $100 million of stock in July—through the 26th of the month, which suggests buyback activity was light in the third quarter.

Underwriting profits at Berkshire’s huge property and casualty Insurance operations could be higher in the third quarter and Berkshire may recognize profits from a big $15 billion policy covering Florida hurricanes given light storm activity in the quarter.

It isn’t easy predicting Berkshire’s earnings given the company’s huge size and complexity, with dozens of businesses and Buffett’s refusal to provide any guidance.

Berkshire also is one of the few big companies that doesn’t hold a quarterly conference call. Barron’s has argued calls would be beneficial to investors, but Buffett had resisted the idea. There is little analyst coverage of Berkshire.

James Shanahan, an analyst at Edward Jones, sees some weakness in Berkshire’s housing-related businesses because of higher rates. And earnings for Burlington Northern Santa Fe, the company’s big railroad unit, could be lower based on weaker results already reported by its main competitor,

Union Pacific

(UNP).

Buffett tells investors to ignore the headline earnings figure and focus on the operating profits, excluding changes in the value of Berkshire’s $350 billion equity portfolio that flows through Berkshire’s income statement based on accounting rules.

“The amount of investment gains (losses) in any given quarter is usually meaningless and delivers figures for net earnings per share that can be extremely misleading to investors who have little or no knowledge of accounting rules,” Buffett regularly states in Berkshire’s earnings release

Berkshire’s Class A stock, which is up 1% Wednesday to $523,200, has risen about 11.5% this year, in line with the total return of the S&P 500 index.

Berkshire’s equity portfolio, which is dominated by Apple (AAPL), had a weak third quarter.

Apple stock was down 12% in the third quarter, which cut the value of Berkshire’s stake—more than 900 million shares at last count—by about $20 billion.

Apple accounts for almost 50% of the Berkshire stock portfolio. Other large Berkshire holdings such as

Bank of America

(BAC), American Express, and

Coca-Cola

also saw their stocks decline in the third quarter.

Investors also will be interested to see if Berkshire further reduced its sizable stake in

Chevron

(CVX) in the period, which it has done in recent quarters. Berkshire held 123 million shares now worth about $18 billion at the end of the second quarter, and the reductions could signal more to come in the third quarter given how CEO Buffett sometimes operates. Berkshire has steadily reduced or eliminated stakes in such holdings of

U.S. Bancorp

(USB) and

Bank of New York Mellon

(BK) in the past year.

Shanahan noted there had been some additional declines in the portfolio in the current quarter through early this week.

Shanahan estimates that Berkshire’s book value declined by about 4% in the third quarter, to $359,000 for a class A share, from the second-quarter figure. That would mean Berkshire stock now trades for about 1.45 times book value. The current price/book ratio is in line with the average of the past two years.

Shanahan thinks cash could grow from about $147 billion on June 30 because of equity sales already disclosed and operating profits in the period. Cash could top $150 billion on Sept. 30 which would be a record. Berkshire paid about $3 billion for a natural-gas business in the period.

Since Berkshire doesn’t pay a dividend, operating profits pile up on the company’s balance sheet unless they are invested.

Corrections & Amplifications

The value of Berkshire Hathaway’s equity portfolio is about $350 billion. An earlier version of this article incorrectly said the value was $350 million.

Write to Andrew Bary at [email protected]

Read the full article here