Zoe Liu wanted to study pipelines, but someone beat her to it.

She pivoted. Instead of investigating the flow of natural gas between countries, she changed her focus to financial flows. This led back to her home country of China which invests the world’s largest stockpile of foreign currency.

Who manages the money? What are their goals? Will China’s system become a model for other countries? She answers these questions in her new book: Sovereign Funds: How the Communist Party of China Finances its Global Ambitions.

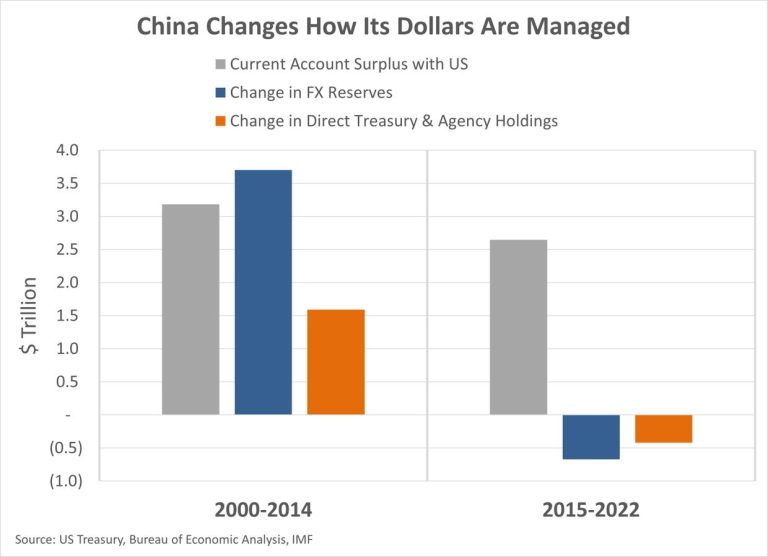

The graph below shows the big picture. China runs a huge current account surplus with the US. Before 2014 it stockpiled this income as reserves, investing a large portion in US Treasury and Agency bonds.

Then things changed.

The second set of bars shows what happened. The surplus with the US still exists, but the accumulated dollars are no longer added to reserves. Instead, the money is moved into a network of what Liu calls ‘sovereign leveraged funds’.

What are these funds and how do they invest?

Central Huijin: China’s “Shareholder-in-Chief”

When China transitioned to capitalism its state banks were simply ‘cashiers’ who channeled money to politically preferred borrowers. The results were predictable. By 2001 around 20% of those loans had gone bad.

Central Huijin was created to fix this.

It started in 2003 as a special policy vehicle and was allocated $45 billion of FX reserves as capital. That money was used to plug holes in state bank balance sheets. Once the balance sheets were repaired, some of the biggest banks sold equity to foreign investors and later listed on the stock market via IPOs. It was a stunningly successful leveraging of FX reserves to fix an important domestic problem.

A few years later Central Huijin executed a successful restructuring of the brokerage industry and over time it has grown to become the ‘shareholder in chief’ of China’s financial institutions. Its ownership stakes in banks, brokerages and insurance companies gives the state immense ability to influence financial markets. Liu believes Central Huijin may currently be helping calm the storm sweeping through the asset management industry.

China Investment Corporation (CIC): The World’s Investment Partner

By mid-2006 China’s FX reserves had grown to $900 billion and 70% was invested in US Treasuries or Agencies. The central bank (PBOC) believed the strategy was appropriate, but the Ministry of Finance (MOF) felt too much was invested in low-yielding US government bonds. In 2007 the MOF prevailed and CIC was founded under its jurisdiction to invest in higher-return assets.

Things started badly.

CIC’s first purchases were direct stakes in several US financial institutions which plummeted in value during the GFC. Although CIC eventually recovered its losses, the domestic publicity was bad. To diversify its financial risk and assume a lower profile, CIC pivoted to indirect investing via foreign private equity funds.

This helped with domestic publicity but soon attracted regulatory scrutiny and negative press in foreign countries. CIC shifted again. It began allocating money to “partnership funds” – joint ventures with politically connected firms in local countries. CIC has partnership funds in many countries including the US, Germany, France, Italy and…Russia.

This was astute. For example, CIC partners with Goldman Sachs in the US. In 2019 the partnership fund agreed to buy Boyd Corp, a maker of engineered materials. Congress initially blocked the deal, but Goldman was able to get the decision changed. Two years later, despite terrible relations between the two countries, the fund was allowed to lead an investment in Project44, a Chicago-based supply chain technology company. Its impossible to imagine CIC doing these deals without Goldman’s help.

CIC’s learning curve was not just financial. Over time its investments have shifted from being primarily return-driven to acquiring assets deemed strategic by the Chinese Communist Party (CCP). These include foreign resource companies and domestic technology firms. It also supports the CCP’s agenda by providing loans to state-owned enterprises as they “go out” and acquire stakes in companies operating in prioritized sectors. Perhaps as a reward, CIC gained more power at the expense of the PBOC by bringing Central Huijin under its umbrella.

Not So SAFE: State Administration of Foreign Exchange

The PBOC did not take this loss of power sitting down. Starting in 2011 its FX management arm, SAFE, began moving money into a web of foreign and domestic investment funds which may control $1.3 trillion. The true amount is difficult to know because only some of SAFE’s funds are listed in the PBOC’s reports.

Like its rival CIC, the funds controlled by SAFE increasingly focus on politically important areas. The most important is the Belt and Road Initiative (BRI), Xi Jinping’s vision of tying countries to China through infrastructure projects. One of SAFE’s funds, Buttonwood Investments, capitalized the Silk Road Fund, the BRI’s main financing vehicle. SAFE also pioneered the lending of foreign exchange to state-owned companies at below-market rates. This helps them buy stakes in foreign companies operating in politically important sectors.

Is your head spinning? Mine was too, so I tried to simplify all this into a summary table:

A Book That Can No Longer Be Written

Could Liu write her book if she was starting now instead of eight years ago? I asked this question during our interview on the Ideas Lab podcast.

Her answer: probably not.

Chinese sources would be reluctant to talk and she might run afoul of ‘foreign espionage’ rules. That’s a shame, because there is much to be admired in how China has professionalized and adapted the way it manages its wealth.

A more transparent approach would generate less skepticism and concern in other countries, which would work in China’s favor. Unfortunately, more transparency is unlikely, which is why we’re lucky someone else is writing about pipelines so Zoe Liu can keep researching China’s sovereign funds.

Read the full article here