The Prudent Speculator, the value-oriented investment newsletter I have edited for more than three decades, has been guided–through thick and thin–by three core tenets: patience, selection and diversification.

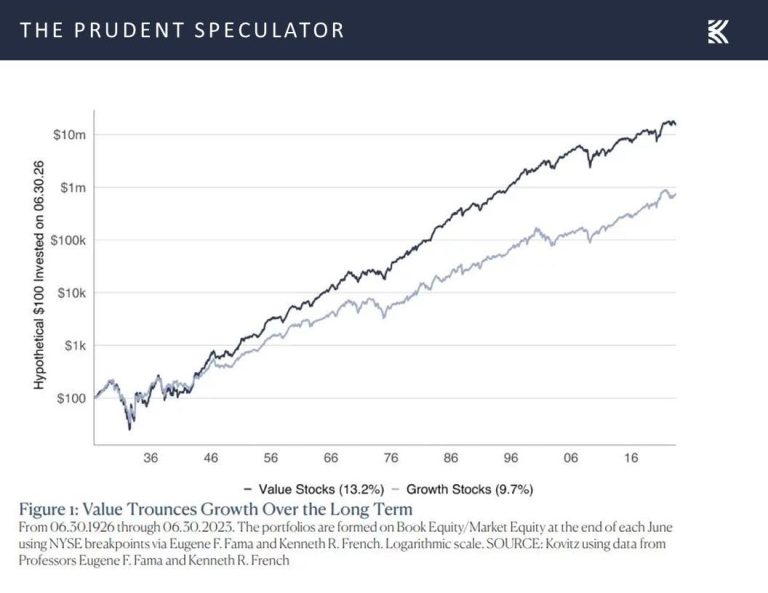

I believe selection improves the odds of success and have always championed value investing, which is the ownership of assets at bargain prices. At the core is the notion that today’s price is below the future value. In practice, I am happy to pay a low price for a stock today that I expect is going to be worth more in the future.

Despite sharing the same ultimate target of capital appreciation with Growth investors, Value and Growth folks see the world differently. For Growth investors, the valuation (e.g. P/E ratio) one pays today tends to take a back seat to whether metrics like revenue, earnings, customers, et cetera are expected to grow at a satisfactory rate. Other market participants tend to have similarly high expectations for these companies, forcing investors to pay “expensive” relative prices for their shares. To see prices rise, Growth stocks must grow their businesses and meet often-lofty targets, leaving little margin for error.

Value investors prefer to pay less than market rates for their shares, enabling shareholders to make money two ways. The first occurs when a stock’s multiples revert to the historical average of the company/industry/market, often spurred by improving investor sentiment. For example, a stock might trade at a ‘discounted’ 10x P/E ratio, while the norm is 15x. Should the stock earn the normal multiple and earnings stay constant, the stock price will rise, even though there was no change to the underlying business. The second is growth in the bottom line, which can be aided by an upswing in cyclical trends, a weathering or reduction in headwinds, business restructuring and/or better management execution.

In the latest Special Report on the subject, I offer additional rationale in support of Value.

And below I detail two stocks we just bought for TPS Portfolio, the flagship, real-money portfolio that has been at the heart of The Prudent Speculator since the newsletter’s founding in 1977!

HIGH-YIELDING PHARMA TITAN

Pfizer

PFE

Recently, PFE shareholders were also reminded that Uncle Sam can giveth and taketh away (almost simultaneously), with President Biden saying he would seek new funding from Congress for an updated COVID-19 vaccine as new mutations of the virus reveal themselves, even as the jointly-produced medication Eliquis was selected as one of the first 10 for mandated 2026 Medicare price negotiations.

Push and pull with regulators, governments, competitors and even society will always be present, but I think Pfizer’s foundation is solid, based on strong cash flows derived from a diverse basket of drugs. I also find the current multiple of 12 times NTM EPS and large dividend yield of 4.8% attractive for the scale, portfolio of existing products and drug pipeline with more than 20 therapies in Phase 3 trials.

FORMER GROWTH STOCK NOW A VALUE NAME

PayPal

PYPL

Since July 2021, investors have headed for the exits and shares have fallen 80%, creating today’s discounted purchase opportunity. This is especially true as PayPal gets its new leader this month in Alex Chriss from Intuit

INTU

Read the full article here