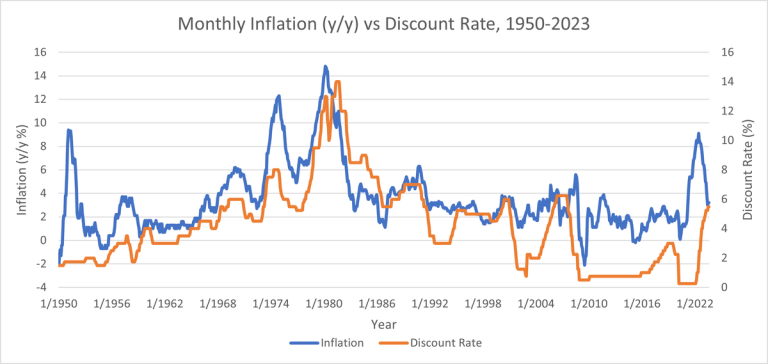

The current economic, inflation, and interest rate cycle has been extremely unusual, driven by the worst global pandemic in over 100 years. Governments around the world reacted in a variety of ways. In the US, one of the governmental responses was to create negative real interest rates as well as issue record amounts of stimulus money into the economy. The US Federal Reserve, uncertain about the outlook for the economy and the affect Covid would have on the consumer and businesses, was fearful to raise interest rates and choke off any economic recovery. As a result, as inflation moved higher in the US, driven by the end of Covid lockdowns and aided by the previously mentioned government stimulus and negative real rates, the Federal Reserve did not react promptly. This resulted in a large gap between the Fed Discount rate and inflation. As seen in Figure 1, the gap reached record levels in 2022 and left the Federal Reserve greatly behind the current economic conditions.

The current economic, inflation, and interest rate cycle has been extremely unusual, driven by the worst global pandemic in over 100 years. Governments around the world reacted in a variety of ways. In the US, one of the governmental responses was to create negative real interest rates as well as issue record amounts of stimulus money into the economy. The US Federal Reserve, uncertain about the outlook for the economy and the affect Covid would have on the consumer and businesses, was fearful to raise interest rates and choke off any economic recovery. As a result, as inflation moved higher in the US, driven by the end of Covid lockdowns and aided by the previously mentioned government stimulus and negative real rates, the Federal Reserve did not react promptly. This resulted in a large gap between the Fed Discount rate and inflation. As seen in Figure 1, the gap reached record levels in 2022 and left the Federal Reserve greatly behind the current economic conditions.

History clearly shows worse performance for the US stock market while the curve is inverted. However, note that the sample size for inversion periods is fairly small at only 11% of all weeks since 1970. Figure 2 demonstrates that the further our from each week the curve is inverted, the greater the negative returns have been.

On a more granular basis, the worst forward equity market performance occurs when the yield curve is inverted between -51 to -100 basis points, which is the present situation. Historically, when this occurred, forward six-month returns were -4.2% to -5.7%. The table in Figure 3 details four- to 52-week returns based on the shape of the yield curve.

Since November 2022, returns have gone against historical averages. In just over nine months since the curve inverted, the S&P 500 is still up around 9%, despite having given back 5% recently. The year-to-date market continues to be an outlier, although continually going against history seems like an uphill battle.

Historically, the stock market has tended to have significant selloffs when the curve steepens from a low or inverted level (see 1970, 1980, 1982, 2003, 2007 in Figure 4). Normally the steepening during inversions occurs from the short end of the yield curve falling as opposed to the long end rising as has happened this year. Also, bear markets during a curve flattening and inverting are rarer but have occurred as well (1973, 2022).

As seen in Figure 5, there is not much difference between a steepening or flattening yield curve overall. However, in either case, an inverted yield curve has resulted in weak stock market averages. A yield curve that is both inverted AND steepening is essentially the worst scenario, although it also has the fewest occurrences. This is potentially the current situation. For calculation purposes, we used a curve change over a four-week period for this section.

Figure 5: S&P 500 Forward Returns in Steepening/Flattening Yield Curve Scenarios

As seen on the Datagraph™ in Figure 6, US 10-year yields have broken a multi-decade downtrend. It is possible that the Federal Reserve may raise interest rates again. If this occurs, US 10-year yields could approach 4.75%-5%, which would likely be a negative for stocks.

Figure 6: US 10 Year Treasuries

Figure 7 below demonstrates sector performance when the yield curve is positively sloped, and Figure 8 shows sector performance when inverted. If there is a positive takeaway from these tables, it is that the commodity sector has a history of positive returns (see Basic Material and Energy), when inverted. On the other hand, performance has been worst for the Consumer Cyclical, Technology, and Financial sectors with an inverted curve.

Figure 7: Forward Sector Performance when Yield Curve is Positive/Normal

Figure 8: Forward Sector Performance when Yield Curve is Negative/Inverted

With this backdrop, we suggest at least part of a portfolio dedicated to stocks that may be a counterbalance. This includes companies with lower debt ratios, strong long-term earnings growth and stability, high return metrics (return on invested capital, return on equity). Figure 9 lists a handful of stocks that score highly on these metrics, and which are also acting very well amid the recent general market weakness.

Figure 9: Stocks of Interest

In conclusion, if one uses history as a guide, the current inverted and steepening yield curve normally portends negative returns for equities over the coming three-to-twelve months. Given the strong performance year-to-date in US stocks, with the NASDAQ

NDAQ

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Company, an affiliate of O’Neil Global Advisors, made significant contributions to the data compilation, analysis, and writing for this article.

Disclosures

No part of the authors’ compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed herein. O’Neil Global Advisors, its affiliates, and/or their respective officers, directors, or employees may have interests, or long or short positions, and may at any time make purchases or sales as a principal or agent of the securities referred to herein.

O’Neil Global Advisors, Inc. (OGA) is an SEC Registered Investment Advisor. Information relating to investments in entities managed by OGA is not available to the general public. Under no circumstances should any information presented in this report be construed as an offer to sell, or solicitation of any offer to purchase, any securities or other investments. No information contained herein constitutes a recommendation to buy or sell investment instruments or other assets, nor to effect any transaction, or to conclude any legal act of any kind whatsoever in any jurisdiction in which such offer or recommendation would be unlawful. The past performance of any investment strategy discussed in this report should not be viewed as an indication or guarantee of future performance. Nothing contained herein constitutes financial, legal, tax or other advice, nor should any investment or any other decision(s) be made solely on the information set out herein.

© 2023, O’Neil Global Advisors Inc. All Rights Reserved. No part of this material may be copied or duplicated in any form by any means or redistributed without the prior written consent of OGA.

Read the full article here