Against all odds—or so it seemed when the pandemic began—financial assets weathered the economic storm pretty well, but some kinds of investments have done far better than others.

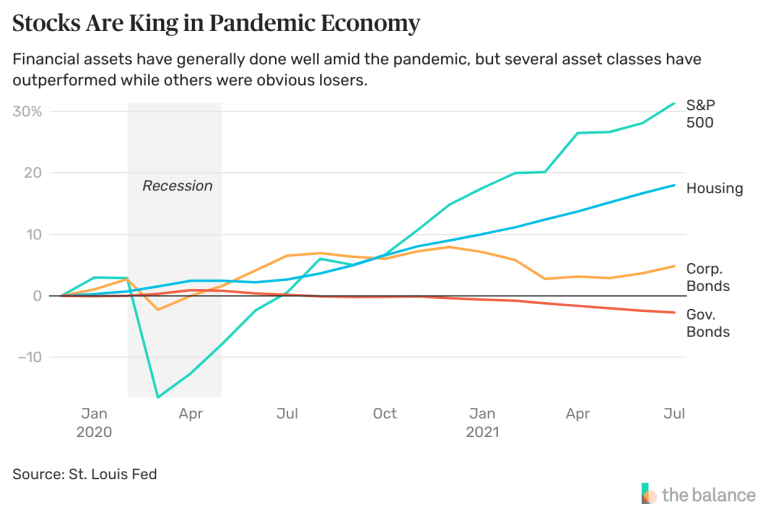

Indeed, equities have been doing so well that some analysts think they’re in a bubble ripe for popping. If you put your money in the stocks of the S&P 500 benchmark index at the end of 2019, for example, you would have seen an impressive cumulative real return of more than 30% by mid- 2021, according to an analysis last week by researchers at the Federal Reserve Bank of St. Louis. But if you bought government bonds—well, not so much. Their value didn’t even keep up with inflation. The chart below shows the period’s stars and duds.

Looking at this performance and the rapid increase in home prices, the strong return on assets makes the 2020 downturn pretty unusual as recessions go, researchers at the St. Louis Fed said.

“Compared with the aftermath of previous recessions, returns on assets have not only recovered relatively fast, but also grown significantly,” they wrote. “This growth has had a positive effect on the wealth of households across the country.” They pointed out, however, that older households, who’ve had more time to accumulate assets, enjoyed greater returns than younger ones just starting out.

Have a question, comment, or story to share? You can reach Diccon at [email protected].

Read the full article here