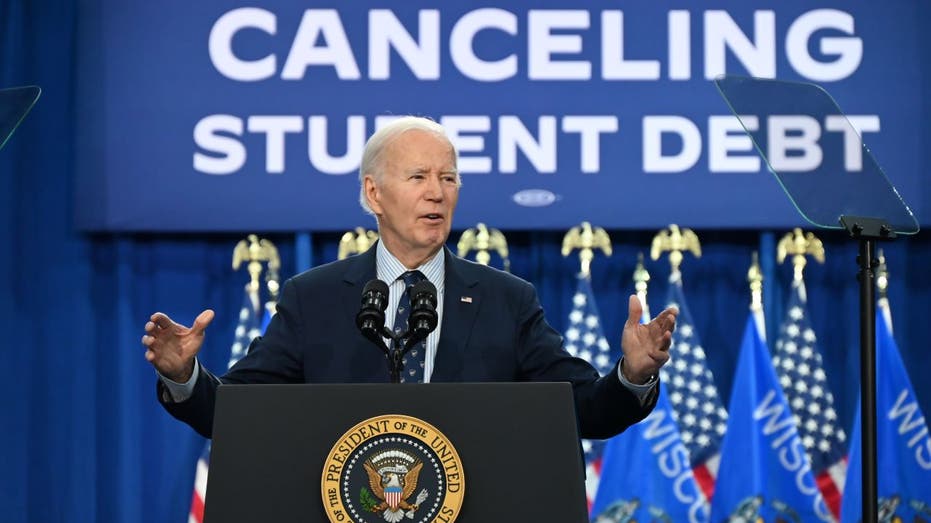

The Biden-Harris administration on Thursday announced another round of student loan handouts, removing $4.5 billion in debt for more than 60,000 borrowers who work in public service.

The Department of Education said in a news release the relief came about from “significant fixes” to the Public Service Loan Forgiveness (PSLF) Program. The action brings the total loan forgiveness approved by President Biden to more than $175 billion for 4.8 million Americans, including $74 billion for more than one million borrowers through PSLF.

“When President Biden and I took office, only 7,000 people had ever been approved for Public Service Loan Forgiveness. Today, I am proud to say that a record one million teachers, nurses, first responders, social workers, and other public service workers have received student debt cancelation,” Vice President Kamala Harris said in a White House statement.

A White House announcement on Thursday morning put the total value of the handouts at $4.7 billion, but later adjusted it to $4.5 billion.

NEW FEDERAL JUDGE BLOCKS STUDENT LOAN HANDOUT DAY AFTER BIDEN’S COURT WIN

“Our Administration has forgiven over $170 billion in student debt for nearly five million people throughout the country — more than any Administration in history,” added Harris, who is currently the Democratic nominee for president in the 2024 election.

The PSLF program’s purpose is to forgive student loan debt for government and nonprofit workers after 10 years of qualifying payments. But according to the Biden-Harris administration, the program rejected 97.9% of applicants leading up to Biden’s presidency. The Education Department has since enacted major reforms to expand eligibility for debt cancelation, including counting previous payments made in other federal loan forgiveness programs towards the PSLF threshold.

FEDERAL JUDGE HANDS BIDEN WIN AS REPUBLICANS CHALLENGE STUDENT LOAN BAILOUT

These adjustments to the program have led to a series of loan handouts over many months, most recently in July, when an additional 35,000 borrowers obtained $1.2 billion in PSLF relief.

However, President Biden’s wider campaign promise to eradicate all federal student loan debt held by borrowers has met several defeats in court. Earlier this year, a group of GOP-led states filed a lawsuit to halt Biden’s SAVE income-driven repayment plan, which is designed to make student loan payments more affordable and forgive accrued debt after 10 years of repayment.

Republicans have described the Democratic president’s student loan forgiveness approach as an overreach of authority and an unfair benefit to college-educated borrowers, while others receive no such relief.

FEDERAL JUDGE BLOCKS REVAMPED BIDEN STUDENT LOAN HANDOUT, LATEST LEGAL SETBACK FOR THE ADMINISTRATION

Two weeks ago, St. Louis-based U.S. District Judge Matthew Schelp, an appointee of Republican former President Trump, issued a preliminary injunction blocking the Biden administration from “mass canceling” student loans and forgiving principal or interest under the plan, pending the outcome of the state’s lawsuit.

Previously, the Supreme Court in a 6-3 decision struck down an effort by Secretary of Education Miguel Cardona to cancel more than $430 billion in student loan debt. A second attempt by the Biden administration to do the same for 30 million student loan borrowers under the Higher Education Act of 1965 has also stalled in court.

A senior administration official said Wednesday the Education Department will continue to move forward with targeted relief for borrowers pending litigation on Biden’s sweeping student loan handout plans.

“From day one of my Administration, I promised to fight to ensure higher education is a ticket to the middle class, not a barrier to opportunity,” Biden said Thursday in a statement. “I will never stop working to make higher education affordable — no matter how many times Republican elected officials try to stop us.”

Reuters contributed to this report.

Read the full article here