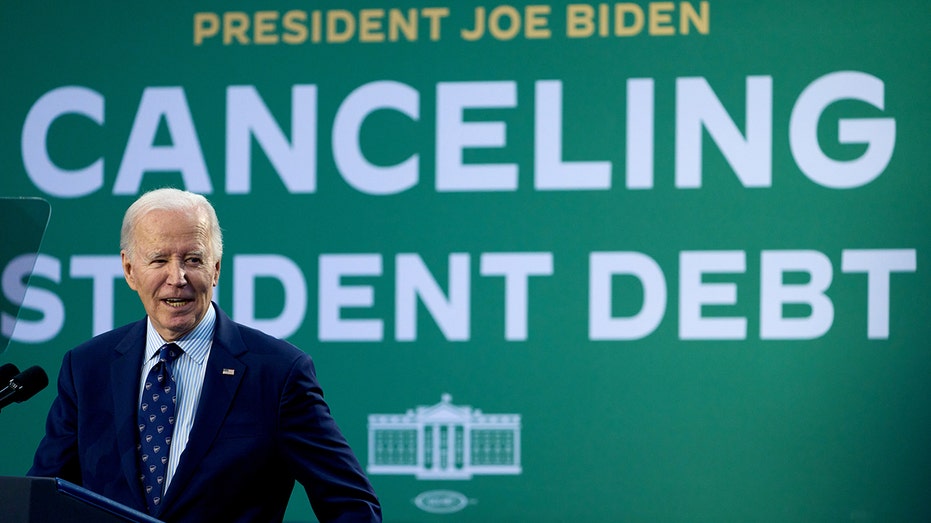

President Biden announced the approval of student loan handouts for more than 150,000 people on Monday, with the White House touting a total of more than 5 million beneficiaries over the course of the president’s term.

With just one week left in office, Biden said his administration “has taken historic action to reduce the burden of student debt, hold bad actors accountable, and fight on behalf of students across the country.”

“These 150,000 borrowers include: almost 85,000 borrowers who attended schools that cheated and defrauded their students, 61,000 borrowers with total and permanent disabilities, and 6,100 public service workers,” Biden said in a statement.

Biden boasted that his administration has also provided a record-high boost to the maximum amount for Pell Grants in the past 10 years.

BIDEN ADMINISTRATION REVERSES COURSE, REOPENS INCOME-BASED STUDENT LOAN REPAYMENT PROGRAMS

“I promised to ensure higher-education is a ticket to the middle class, not a barrier to opportunity, and I’m proud to say we have forgiven more student loan debt than any other administration in history,” Biden said in the statement.

The Department of Education noted that the latest move brings the total amount of the administration’s handouts to $183.6 billion.

Last month, two student loan repayment plans were reopened for enrollment by the Department of Education (DOE) following a federal court injunction against the Biden administration’s Saving on a Valuable Education (SAVE) program.

SUPREME COURT RULES AGAINST BIDEN STUDENT LOAN DEBT HANDOUT

New enrollment in the Pay As You Earn (PAYE) and Income-Contingent Repayment (ICR) programs was halted last summer in an attempt to phase them out and encourage borrowers to sign up for the Biden-Harris administration’s SAVE plan, but now people can sign up once again.

The two reinstated plans offer credit for Public Service Loan Forgiveness and income-driven repayment. Monthly payments are set by a borrower’s earnings, family size and allow borrowers to earn forgiveness after “extended periods of payments,” the DOE said.

PAYE and ICR new enrollments will be open until July 1, 2027, the DOE said.

Read the full article here