The Supreme Court of the United States (SCOTUS) denied the Biden administration’s request to lift a block on the Saving on a Valuable Education (SAVE) plan, which is designed to ease the burden of student loan debt for millions of borrowers.

A federal appeals court in Missouri blocked the entire SAVE program from being enforced while litigation over the merits continues in the lower courts. The Department of Justice, which is part of the Biden administration, most recently asked the high court for emergency relief.

The request went to Justice Brett Kavanaugh, who has jurisdiction over time-sensitive applications from Missouri.

The Supreme Court justice asked Missouri and six other GOP-led states to respond to the appeal in writing by Aug. 19.

DEM STAFFER BLASTED FOR SPENDING HABITS AFTER GOING VIRAL FOR THANKING BIDEN FOR ERASING $8K STUDENT DEBT

On Wednesday, Kavanaugh denied the request. The order states the Court expects the Court of Appeals to render its own decision.

In its appeal, the Biden administration said the 8th Circuit U.S. Court of Appeals went too far when it issued a nationwide injunction, which effectively put a temporary freeze on the SAVE plan.

“Our Administration will continue to aggressively defend the SAVE Plan – which has helped over 8 million borrowers access lower monthly payments, including 4.5 million borrowers who have had a zero dollar payment each month,” a White House spokesperson told Fox News Digital. “And, we won’t stop fighting against Republican elected officials’ efforts to raise costs on millions of their own constituents’ student loan payments.”

Missouri Attorney General Andrew Bailey said the court’s decision was “a huge win for every American who still believes in paying their own way.”

“This is the second time the Supreme Court has sided with my office against one of Joe Biden and Kamala Harris’ unlawful student loan cancellation schemes,” Bailey said. “This court order is a stark reminder to the Biden-Harris Administration that Congress did not grant them the authority to saddle working Americans with $500 billion in someone else’s Ivy League debt.”

FEDERAL COURT BACKS MISSOURI AG MOTION TO BLOCK BIDEN’S ‘ILLEGAL’ STUDENT LOAN HANDOUT PLAN

Also weighing in on the Supreme Court’s decision was the Department of Education, which was “disappointed” with the result.

“We are disappointed in this decision, particularly because lifting the injunction would have allowed for lower payments and other benefits for borrowers across the country. The Department will work to minimize further harm and disruption to borrowers as we await a final decision from the Eighth Circuit,” a spokesperson for the Department of Education told Fox News. “The Biden-Harris Administration remains committed to supporting borrowers and will continue to fight for the most affordable repayment options for millions of people across the country.”

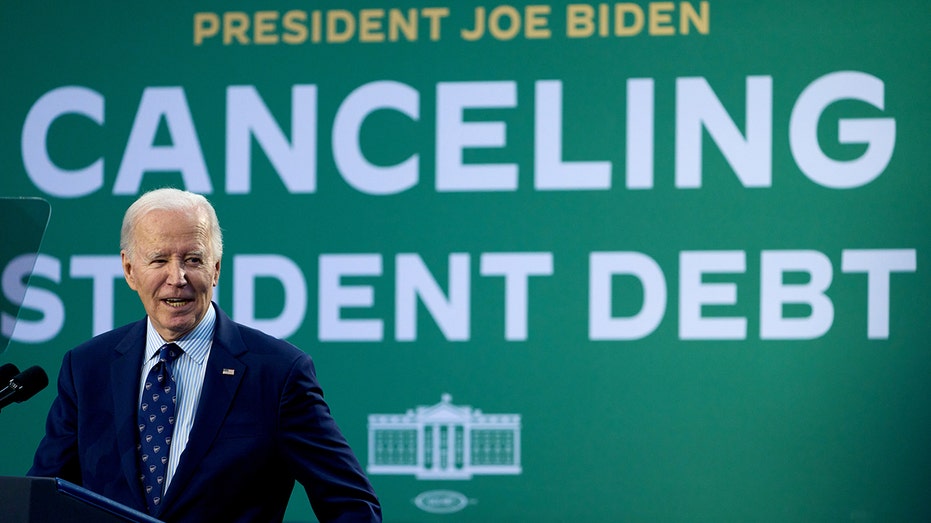

Biden introduced SAVE after the Supreme Court struck down his proposed student loan forgiveness plan. The White House said that the SAVE plan could lower borrowers’ monthly payments to zero dollars, reduce monthly costs in half and save those who make payments at least $1,000 yearly. Additionally, borrowers with an original balance of $12,000 or less will receive forgiveness of any remaining balance after making 10 years of payments.

WHAT TO KNOW ABOUT BIDEN’S LATEST ATTEMPT AT STUDENT LOAN CANCELATION

Legal challenges from Republican-led states resulted in a temporary block of the program until the litigation concluded. The 8th Circuit Court of Appeals issued a preliminary injunction blocking the SAVE student loan repayment plan. The block prevents the Department of Education from offering the plan while litigation continues. In the meantime, borrowers enrolled in the SAVE Plan are being moved into forbearance while the Biden administration defends the plan in court.

The appeal from the administration is separate from a lawsuit brought against the income-contingent SAVE Act by Alaska and other states in another appeals court. An emergency request for an injunction to block the student loan forgiveness plan in that case is also pending at the Supreme Court.

Fox News’ Nora Colomer and Nicole McManus contributed to this report.

Read the full article here