Americans consider $1.46 million the minimum for a comfortable retirement, a Northwestern Mutual study found. However, the threshold of savings required to retire well varies considerably across states.

No matter where you spend your golden years, it’s important to be realistic about how much cash you’ll need to fund the future.

People should try living on their expected retirement budget for a few years and factor inflation into long-term money goals, financial expert Stacey Black told Entrepreneur last year.

Related: Here Are the Best and Worst States for Retirement in 2025, According to a New Report

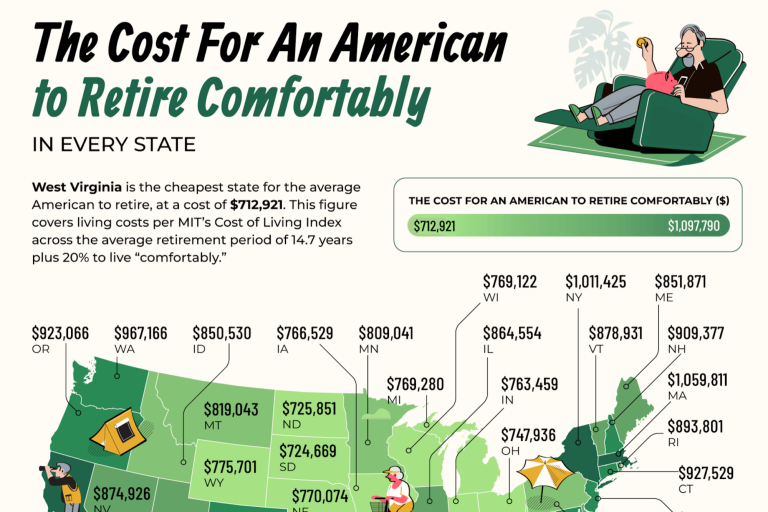

A new study from online lender NetCredit reveals how much money Americans need to retire comfortably in every U.S. state in 2025. Researchers calculated the average length of retirement (nearly 15 years per U.S. life expectancy and retirement age) and multiplied it by each state’s cost of living, then increased it by 20% to allow for a more “comfortable” retirement.

The study found that West Virginia, Arkansas and South Dakota are the least expensive states in which to retire comfortably in 2025, requiring $712,921, $715,126 and $724,669, respectively.

Hawaii ($1,097,790), Massachusetts ($1,059,811) and California ($1,053,814) rounded out the top three most expensive states in which to retire well, per the data.

Related: Early Retirement vs. Delayed Retirement: Which Is Right for You?

Check out NetCredit’s map below for the full state-by-state breakdown of just how much a comfortable retirement costs across the U.S.:

Image Credit: Courtesy of NetCredit

Americans consider $1.46 million the minimum for a comfortable retirement, a Northwestern Mutual study found. However, the threshold of savings required to retire well varies considerably across states.

No matter where you spend your golden years, it’s important to be realistic about how much cash you’ll need to fund the future.

People should try living on their expected retirement budget for a few years and factor inflation into long-term money goals, financial expert Stacey Black told Entrepreneur last year.

The rest of this article is locked.

Join Entrepreneur+ today for access.

Read the full article here