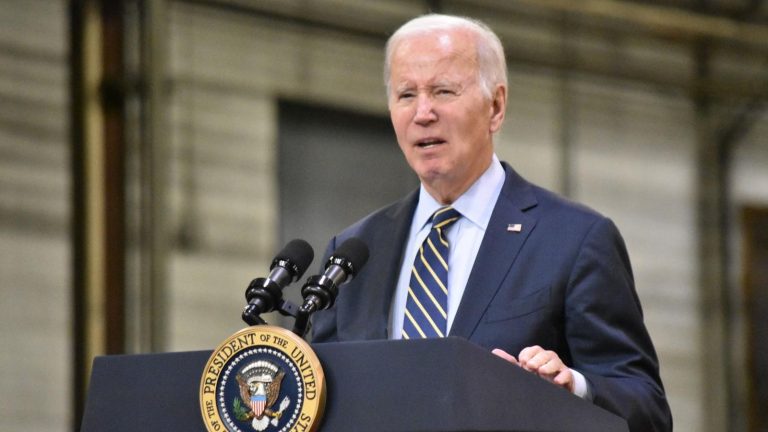

Nearly three million borrowers won’t have to make payments on their student loans under a new repayment plan, the Biden administration said this week. The Education Department released new data indicating that millions of borrowers have signed up for the new initiative, with more than half exempted from student loan payments based on their income.

Here’s the latest.

Biden’s New SAVE Plan Means Lower Payments And Eventual Student Loan Forgiveness

The Biden administration unveiled the Saving on a Valuable Education plan earlier this year in anticipation of student loan payments resuming. SAVE is an income-driven repayment plan that ties a borrower’s monthly payments to their income and family size. Enrolling in SAVE can also result in eventual student loan forgiveness for borrowers who wind up not repaying their balance in full by the end of their repayment term.

The administration designed SAVE to be a more affordable repayment option than other plans. SAVE excludes a significant amount of income from the plan’s repayment calculation based on an expanded poverty exemption, and then utilizes a more affordable formula for income that exceeds that excluded amount.

At least 5.5 million borrowers had enrolled in SAVE through mid-October, according to Education Department data released this week.

“Under President Biden, the Department created the SAVE Plan so that young people and working families can climb the economic ladder without unaffordable student loan debt weighing them down,” said Secretary of Education Miguel Cardona in a statement on Wednesday. “I’m thrilled to see that in less than three months, nearly 5.5 million Americans in every community across the country are taking advantage of the SAVE Plan’s many benefits.”

Millions Will Have No Payments But Can Still Get Credit Toward Student Loan Forgiveness

Under SAVE’s expanded poverty exemption, a single borrower who earns less than $32,800 annually would have a $0 monthly payment. Since the poverty exclusion limit is adjusted for family size, a borrower with a family size of four making less than $67,000 would also have a $0 monthly payment under SAVE.

According to the Education Department data, 2.9 million borrowers currently enrolled in SAVE — more than half of the total enrollees to date — will have a $0 monthly payment. This means they will not have to make payments on their SAVE-eligible federal student loans. Even $0 “payments” count toward a borrower’s student loan forgiveness term under SAVE, which is either 20 or 25 years depending on whether their federal student loans were taken out for graduate school. A separate Biden administration initiative called the IDR Account Adjustment can result in borrower’s receiving retroactive “credit” toward their IDR student loan forgiveness term.

“Nearly 5.5 million Americans have enrolled in the Biden-Harris Administration’s SAVE plan. And nearly three million Americans now have $0 monthly payments under this plan,” said the White House in a tweet on Wednesday.

Notably, SAVE also has an interest subsidy that will waive any interest that exceeds a borrower’s monthly payment. As a result, these 2.9 million borrowers will also have no interest accrue while their monthly payments are $0. That means their loan balance will not increase over time, which historically has been a major downside of income-driven programs.

Accelerated Student Loan Forgiveness And Other Features Go Live Next Year

Only a portion of the regulations governing SAVE are currently in effect. In July 2024, other features will go live. These include an even more favorable monthly payment formula that will allow undergraduate borrowers to reduce their student loan payments even further by as much as 50%. And borrowers with smaller initial balances could receive student loan forgiveness in as little as 10 years, rather than 20 or 25.

Under all income-driven plans, including SAVE, borrowers must re-certify their income annually as payments are calculated for 12-month increments. Any changes to income could result in adjustments to their monthly payments in subsequent years. The Biden administration is launching an automatic income recertification feature, however, that will allow borrowers to opt into a data-sharing program so that the IRS can provide annual income updates to the Education Department, eliminating the need for borrowers to go through what has historically been a cumbersome manual income renewal process.

Further Student Loan Forgiveness Reading

8 Hardships Could Qualify For Automatic Student Loan Forgiveness Under Biden Plan

Major Student Loan Forgiveness Deadline Nears, But Could Get Extended

Education Department Unveils Major Details On New Student Loan Forgiveness Plan

5 Student Loan Forgiveness Updates As On-Ramp Begins And Problems Worsen

Read the full article here