Many Americans continue to get notified that their home insurance premiums are going to be more expensive.

These increases are due to many factors, including rising building material costs, continuing supply chain issues and ongoing labor shortages, according to the Insurance Information Institute, the leading national trade association of the property and casualty insurance industry.

What is causing the increase in home insurance costs?

Loretta L. Worters, spokesperson of the New York-based Insurance Information Institute, tells FOX Business homeowners’ insurance premium rates have risen significantly due to the pandemic and the state of the U.S. economy.

“Much of the increase can be attributed to supply chain issues and labor shortages driving up the cost of home repairs and replacement costs, but also rising catastrophe losses related to extreme weather and population shifts into disaster-prone regions,” Worters said.

HURRICANE IDALIA COULD COST $20B IN DAMAGES, LOST ECONOMIC ACTIVITY: MOODY’S ANALYTICS

Through September 2023, there have been 23 confirmed weather and climate disasters in the U.S. this year producing losses over $1 billion, according to NOAA.

These trends — rising costs of building materials, appliances and labor; rising insured losses related to extreme weather; and population shifts into disaster-prone locales — predate the pandemic and are unlikely to go away after COVID-19 and its disruption of the global economy fades into history, according to Worters.

“This is why homeowners’ insurance premium rates will need to increase in the years ahead,” Worters told FOX Business.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AON | AON PLC | 324.22 | -5.12 | -1.55% |

| MET | METLIFE INC. | 62.92 | +0.03 | +0.05% |

| AIG | AMERICAN INTERNATIONAL GROUP INC. | 60.60 | -0.68 | -1.11% |

| PRU | PRUDENTIAL FINANCIAL INC. | 94.90 | +0.05 | +0.05% |

| ALL | THE ALLSTATE CORP. | 111.41 | -1.15 | -1.02% |

How do home prices impact homeowners’ insurance rates?

According to Worters, the replacement cost of your home has an impact on homeowner rates, not how much it sells for on the real estate market.

“Replacement cost refers to the amount it would cost to rebuild your home with construction materials of similar type and quality,” she added.

MORTGAGE RATES HIT 23-YEAR HIGH

Replacement Housing Costs

Some of the factors include the type of exterior wall construction — frame, masonry (brick or stone) or veneer. For example, a brick home in Long Island would be less expensive if that same home were built in Los Angeles because of the potential for earthquakes and how that home would hold up in that area, Worters explained.

Other factors:

- The style of the house; for example ranch or colonial

- The number of bathrooms and other rooms

- The type of roof and materials used

- Other structures on the premises such as garages, sheds

- Special features such as fireplaces, exterior trim or arched windows

- Whether the house — or a part of it —was custom-built

Source: Insurance Information Institute

Improvements that have added value to a home, such as the addition of second bathroom, or a kitchen renovation, also contribute to rising rates.

Local rebuilding costs in your area are another factor.

“Keep in mind, inflation can impact rebuilding costs,” Worters told FOX Business. “If you plan on owning your home for a while, it’s even more important to consider adding an inflation guard clause to your policy. An inflation guard automatically adjusts the dwelling limit to reflect current construction costs in your area when you renew your insurance.”

How do disasters potentially impact insurance costs?

After a major catastrophe such as a hurricane, tornado or wildfire, construction costs may rise suddenly because the price of building materials and shortage of construction workers increase due to the widespread demand, according to Worters.

“This price bump may push rebuilding costs above your homeowners’ policy limits and leave you short,” she explained.

FOX WEATHER: LIVE COVERAGE

To protect against this possibility, she explains how an extended replacement cost coverage endorsement can pay an extra 5% to 25% above the limits (available through most insurance companies).

“A guaranteed replacement cost policy will pay whatever it costs to rebuild your home as it was before the disaster and is available through a limited number of insurance companies,” Worters said.

What can homeowners do to mitigate these possible increases?

Mitigation involves a wide range of options to increase the likelihood homes can survive a disaster. For example, defensible space when addressing wildfires, roofs that are fireproof and hurricane clips in hurricane-prone areas.

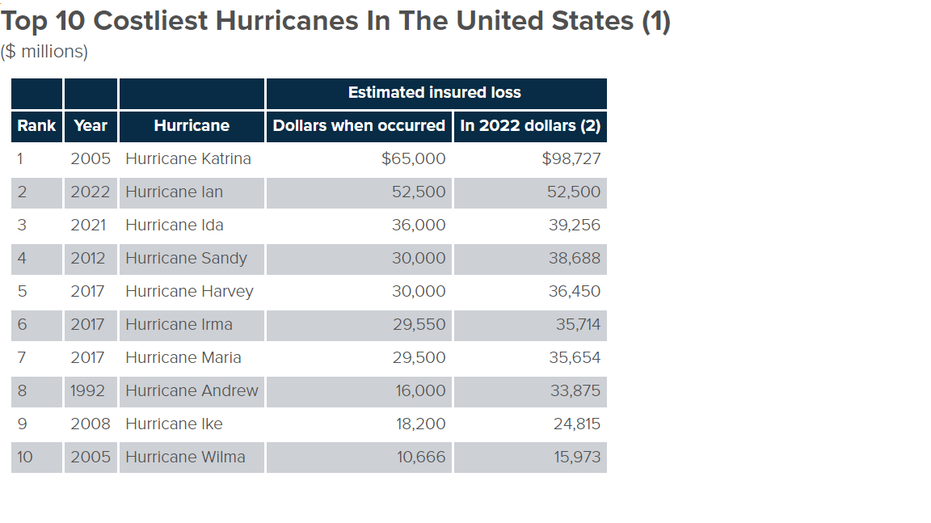

According to the Insurance Information Institute, damage from tornadoes, hurricanes, severe storms, wildfires, floods and other natural disasters reached $92 billion in 2021, bringing the total from 2017 through 2021 to more than $400 billion. Average insured natural catastrophe losses have risen nearly 700% since the 1980s, Worters noted.

Understand your policy language

Most homeowners’ policies today cover replacement costs for structural damage, but it’s wise to check your policy — especially if you have an older home, Worters told FOX Business.

“A replacement cost policy will pay for the repair or replacement of damaged property with materials of similar kind and quality,” she said.

“The limits of your policy typically appear on the declarations page under Section I, Coverages, A. Dwelling. Your insurer will pay up to this amount to rebuild your home.”

If limits of a homeowners’ policy haven’t changed since the purchase of a home, the home may be underinsured – even if it has not had upgrades, Worters said.

Many insurance policies include an “inflation guard” that automatically adjusts the limit to reflect current construction costs in your area when policies are renewed, said Worters.

“If your policy doesn’t include this clause, see if you can purchase it as an endorsement,” she suggested.

Read the full article here