A new survey finds that American homebuyers are anticipating that a recession will occur by early next year, with some buyers suggesting that could make them more likely to buy a home.

The survey by Realtor.com found that in the first quarter of 2025, 63.4% of homebuyers said they think there will be a recession in the last year. That’s the third-highest level of concern in the survey since 2019, following the beginning of the COVID pandemic as well as the Federal Reserve’s interest rate hikes to deal with inflation in 2022-23.

While a majority are expecting a recession to come in the next year, more homebuyers said they view that as a buying opportunity than those who said it would make them less likely to buy.

The survey found that 29.8% of homebuyers said a recession would make them at least somewhat more likely to buy a home — roughly double the 15.8% who said it would make them less likely to do so. The remainder said it would have no impact on their buying decision.

JAMIE DIMON SAYS A RECESSION IS STILL A POSSIBILITY: ‘I WOULDN’T TAKE IT OFF THE TABLE AT THIS POINT’

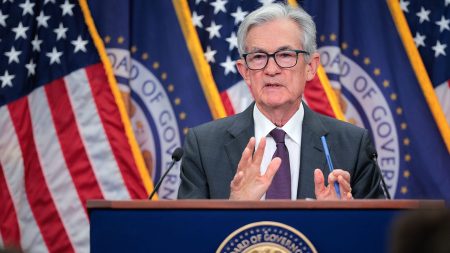

If the U.S. enters a recession, there is a greater likelihood of the Fed cutting interest rates to support the economy. Mortgage rates are influenced in part by movements in the Fed’s benchmark federal funds rate, so cuts by the central bank could make mortgages more affordable for buyers.

“As a result, buyers — especially those with limited down payments — might view a recession as a more favorable time to enter the market,” the report noted.

The more than half of buyers whose home purchasing decisions would be unaffected by a recession may be more focused on long-term homeownership or have financial security such that a downturn doesn’t influence their decisions, Realtor.com wrote.

AMERICA’S HOUSING CRISIS: REALTOR.COM SAYS THERE IS A WAY TO SOLVE IT

“Many of these active home shoppers might already be financially secure, motivated by personal or lifestyle needs, and focused on long-term goals,” Realtor.com said. “For them, short-term economic uncertainty is likely less important than the perceived long-term value of homeownership.”

Potential homebuyers surveyed by Realtor.com also said that one of the top obstacles to buying a home was finding one that meets their needs, with 44.3% reporting they’re unable to do so.

The report noted that active housing inventory is still about 16% below the levels seen from 2017 to 2019, which suggests the market has room to grow.

Another 36% of homebuyers cited budget constraints as a key barrier to a home purchase. Realtor.com noted that those issues could be elevated in the months ahead due to uncertainty over the impact of tariffs, which could strain buyers’ budgets through higher prices.

Read the full article here