Mortgage rates fell again this week, mortgage buyer Freddie Mac said Thursday.

Freddie Mac’s latest Primary Mortgage Market Survey, released Thursday, showed the average rate on the benchmark 30-year fixed mortgage fell to 6.26% from last week’s reading of 6.35%.

The average rate on a 30-year loan was 6.09% a year ago.

TREASURY’S BESSENT SAYS FIXING HOUSING AFFORDABILITY CRISIS WILL BE ONE OF HIS ‘BIG PROJECTS’ THIS FALL

“Mortgage rates decreased yet again this week, prompting many homeowners to refinance,” said Sam Khater, Freddie Mac’s chief economist. In fact, the share of mortgage applications that were refinances reached nearly 60%, the highest since January 2022.”

ONLY 28% OF US HOMES NOW AFFORDABLE FOR TYPICAL AMERICAN HOUSEHOLD AS BUYING POWER DROPS

The average rate on the 15-year fixed mortgage fell to 5.41% from last week’s reading of 5.5%. One year ago, the rate on the 15-year fixed note averaged 5.15%.

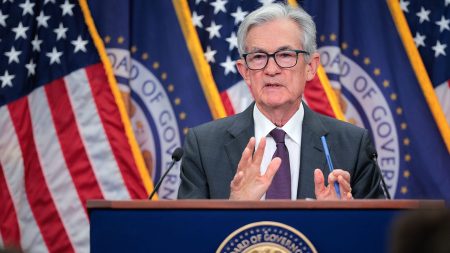

The latest data from Freddie Mac comes a day after the Federal Reserve lowered the benchmark interest rate by 25 basis points.

Following the central bank’s decision to cut rates for the first time since December 2024, the federal funds rate will sit at a new range of 4% to 4.25%. The cut comes after the Fed left rates unchanged at its first five meetings this year amid economic uncertainty.

The Fed’s dot plot shows two more interest rate cuts this year, with 25-basis-point cuts projected at the central bank’s October and December policy meetings. That would leave the federal funds rate at a median of 3.6% this year, within a range of 2.9% to 4.4%.

“Markets expect the federal funds rate to reach 3.0% by mid-2026, while Fed participants see policy remaining slightly above 3% through 2028,” said Realtor.com senior economist Jiayi Xu. “This divergence could place upward pressure on mortgage rates, but for now, borrowers are benefiting as the 30-year mortgage rate has slipped to an 11-month low.”

FOX Business’ Eric Revell contributed to this report

Read the full article here