Mortgage rates rose this week for the first time since mid-July, mortgage buyer Freddie Mac said Thursday.

Freddie Mac’s latest Primary Mortgage Market Survey, released Thursday, showed the average rate on the benchmark 30-year fixed mortgage rose to 6.3% from last week’s reading of 6.26%.

The average rate on a 30-year loan was 6.08% a year ago.

TREASURY’S BESSENT SAYS FIXING HOUSING AFFORDABILITY CRISIS WILL BE ONE OF HIS ‘BIG PROJECTS’ THIS FALL

“Housing market activity continues to hold up with purchase and refinance applications increasing by 18% and 42%, respectively, compared to the same time last year,” said Sam Khater, Freddie Mac’s chief economist.

The average rate on the 15-year fixed mortgage rose to 5.49% from last week’s reading of 5.41%. One year ago, the rate on the 15-year fixed note averaged 5.16%.

“Even with this week’s uptick, mortgage rates remain near 11-month lows, creating opportunities for both buyers and homeowners considering a refinance,” said Hannah Jones, Realtor.com’s senior economic research analyst. “For buyers, the current rate environment is delivering a meaningful boost to affordability.”

ONLY 28% OF US HOMES NOW AFFORDABLE FOR TYPICAL AMERICAN HOUSEHOLD AS BUYING POWER DROPS

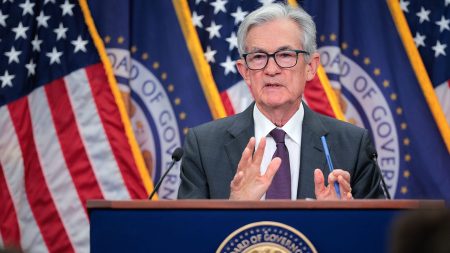

The latest data from Freddie Mac comes a week after the Federal Reserve lowered the benchmark interest rate by 25 basis points.

Following the central bank’s decision to cut rates for the first time since December 2024, the federal funds rate will sit at a new range of 4% to 4.25%. The cut comes after the Fed left rates unchanged at its first five meetings this year amid economic uncertainty.

Meanwhile, sales of new U.S. single-family homes surged to the highest level in more than 3-1/2 years in August, but that likely exaggerates the housing market’s health, and a weakening labor market could limit the boost from falling mortgage rates.

The bigger-than-expected increase in sales last month reported by the Commerce Department on Wednesday was shrugged off by economists, who noted that new housing data was extremely volatile and subject to revisions. They also said the jump in sales was at odds with subdued homebuilder sentiment.

“There is no obvious driver. I expect that this spike in sales will be largely reversed in coming months,” said Stephen Stanley, chief U.S. economist at Santander U.S. Capital Markets.

Reuters contributed to this report

Read the full article here