Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

Based on data compiled by Credible, mortgage rates for home purchases have remained unchanged across all key terms since yesterday.

Rates last updated on July 18, 2023. These rates are based on the assumptions shown here. Actual rates may vary. Credible, a personal finance marketplace, has 5,000 Trustpilot reviews with an average star rating of 4.7 (out of a possible 5.0).

What this means: Mortgage rates for 10- and 15-year terms have maintained their pattern of remaining unchanged, remaining at 5.625% and 7.125%, respectively. Additionally, rates for 20- and 30-year terms have also remained stable, staying at 8.125% and 7.5%, respectively. Borrowers interested in saving the most on interest should consider 10-year terms, as 5.625% is today’s lowest rate. Homebuyers who would rather have a lower monthly payment should instead consider 30-year terms, as they have the lower rate between the two longer terms.

To find great mortgage rates, start by using Credible’s secured website, which can show you current mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s mortgage calculator to estimate your monthly mortgage payments.

Based on data compiled by Credible, mortgage refinance rates have remained unchanged for three key terms, while another has risen since yesterday.

Rates last updated on July 18, 2023. These rates are based on the assumptions shown here. Actual rates may vary. With 5,000 reviews, Credible maintains an “excellent” Trustpilot score.

What this means: Mortgage refinance rates have maintained their pattern of keeping longer terms above 6%, while shorter terms stay within the 5% range. Today, rates for 20-year terms have edged up to 6.5%. Meanwhile, rates for 30-year terms have remained unchanged at 6.625%. Additionally, rates for 10- and 15-year terms have stayed the same at 5.625% and 5.75%, respectively. Homeowners looking for a smaller monthly payment should consider 20-year terms, as their rates are lower than those of 30-year terms. Borrowers who would rather maximize their interest savings should instead consider today’s lowest rate, 10-year terms at 5.625%

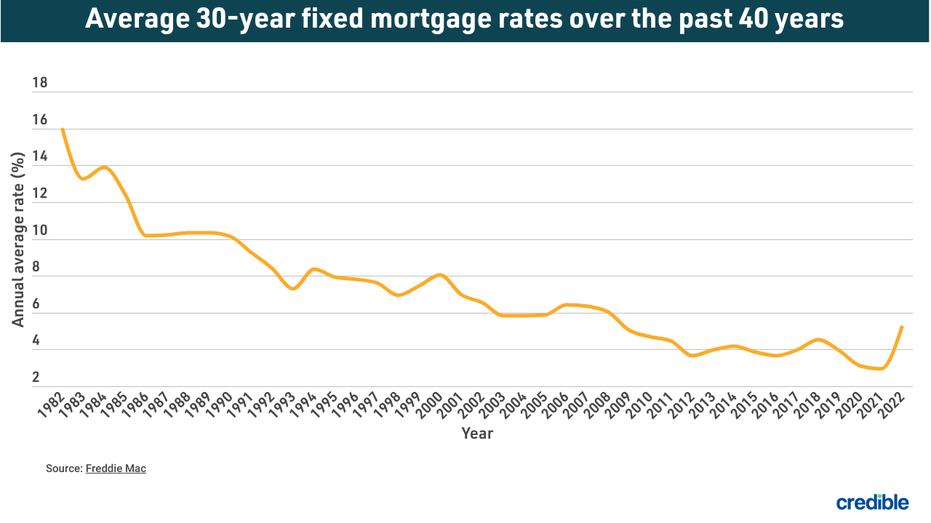

How mortgage rates have changed over time

Today’s mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac — 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of today’s lower interest rates. When considering a mortgage or refinance, it’s important to take into account closing costs such as appraisal, application, origination and attorney’s fees. These factors, in addition to the interest rate and loan amount, all contribute to the cost of a mortgage.

How Credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 700 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates reported here will only give you an idea of current average rates. The rate you actually receive can vary based on a number of factors.

Factors that influence mortgage rates (and are in your control)

Many factors affect what mortgage interest rate you can qualify for, and some of them are within your control. Improving these factors could help you qualify for a lower interest rate.

- Credit score — Generally, the lowest interest rates go to borrowers with the highest credit scores.

- Debt-to-income ratio — DTI is a percentage that compares your total debts with your income. To calculate DTI, divide your monthly gross income by the total of all your monthly minimum debt payments. Generally, lenders prefer a DTI of 35% or less.

- Down payment amount — Generally, lenders (and many sellers) look favorably on a higher down payment amount. If you put down less than 20% of the home’s purchase price, many lenders will require you to pay for private mortgage insurance, which protects the lender (not you) if you fail to repay the mortgage.

- Home location/price — Interest rates can vary depending on what state you live in and where in the state you’re buying. Likewise, if you need to borrow a lot more than average (a jumbo loan) or very little, you may get a higher interest rate.

- Repayment term — The lowest rates typically come with 10- or 15-year terms, while 30-year terms usually have the highest interest rates.

If you’re trying to find the right mortgage rate, consider using Credible. You can use Credible’s free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at [email protected] and your question might be answered by Credible in our Money Expert column.

Read the full article here