Many Americans have been priced out of purchasing a home or making a move for years now amid elevated mortgage rates, sky-high home prices, and squeezed budgets due to inflation.

Although mortgage rates have started to decline some in recent months, the housing market has been largely stalled as would-be buyers and sellers remain on the sidelines, waiting for a more significant decline.

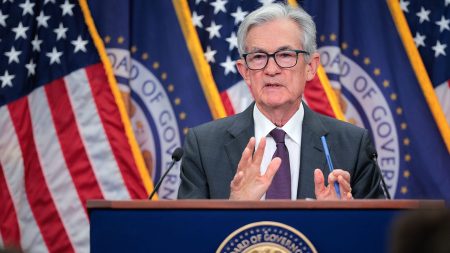

So will the Federal Reserve’s larger-than-expected 50-basis-point rate cut on Wednesday make any difference for mortgage rates?

Last week, mortgage rates fell to their lowest levels in more than 18 months, with the average 30-year fixed rate note dropping to 6.20%. But currently, about 80% of mortgage holders have a rate below 5%, according to a Zillow survey.

FED INTEREST RATE CUTS WON’T HELP YOUR CREDIT CARD DEBT

While a shortage of home inventory is keeping prices high, the Fed’s aggressive rate-hiking campaign on the federal funds rate in its fight to tame inflation has made the affordability crisis even worse.

While the federal funds rate is not what consumers pay directly, it affects borrowing costs for home equity lines of credit, auto loans and credit cards. Mortgage rates are linked to moves in the 10-year Treasury yield.

Derrick Barker, CEO and co-founder of Nectar, a firm that helps professional real estate investors through flexible financing, told FOX Business that in the short term, a 25 – 50-basis point federal funds rate cut was already priced into mortgage interest rates ahead of Wednesday’s decision, noting that mortgage rates are determined by the market – and the market already anticipated a cut.

REAL ESTATE IS A SLOW-MOVING OPERATION: KIRSTEN JORDAN

He predicts that despite the larger cut, mortgage rates are likely to remain roughly where they are now, at least for a while.

“Any further decrease in mortgage rates I would expect to track economic data,” he said. “If the economy continues to weaken, the mortgage market will be expecting to have additional rate cuts from the Fed and will therefore likely reflect lower rates.”

On the other hand, if economic activity improves, Barker says we should expect rates to increase again.

“I would take the Fed at their word in expecting higher rates for longer,” he said. “So the current mortgage rate environment that we have today may be persistent for years to come, barring unanticipated economic swings.”

Read the full article here