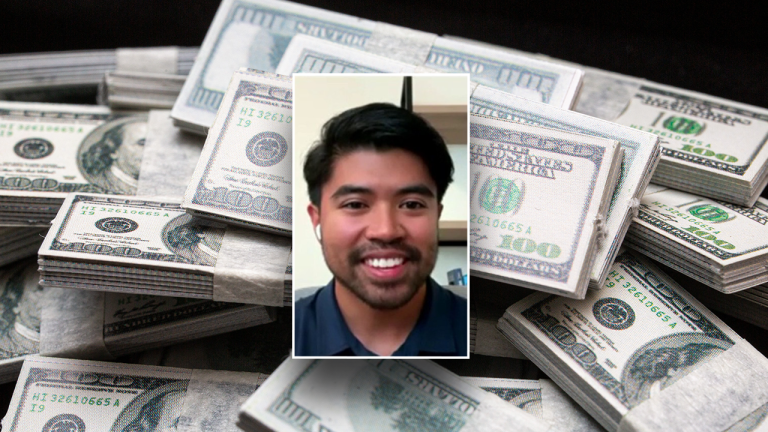

Financial influencer JC Rodriguez, who interviews “quiet millionaires” for his platform “The Frugal Rich,” joined FOX Business’ “Varney & Co.” to discuss how the secret behind their massive net worths isn’t a lottery-ticket, stock or crypto bet, but one simple strategy: consistency.

Rodriguez calls them “quiet millionaires” because you’d never pick them out of a crowd. No fancy cars, no private jets, no viral flexes, just ordinary people who have quietly crossed the seven-figure mark.

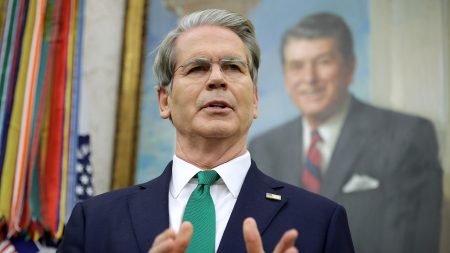

Varney opened the conversation by asking whether the people featured in Rodriguez’s street interview were truly millionaires, prompting Rodriguez to explain, “Yeah, so we just started going out on the streets… to show young people that… we don’t have to romanticize the wealth-building journey. It’s not a question of luck. It’s not about getting a great inheritance… And we did find out these people were in fact millionaires just walking amongst us…”

His street interviews highlight people who look more like your neighbor than the influencers typically associated with wealth on social media. Yet behind their modest appearances are decades of steady saving, disciplined investing and a long-term mindset.

One of those quiet millionaires is a company president Rodriguez stopped on the street. When asked what he does for a living, the man said, “I’m the president of a company,” and when Rodriguez asked if he was now a net-worth millionaire, he responded, “Absolutely.” He described how his investing strategy shifted over the years, “Stock market goes up and down. When you’re younger, you can take risks, but when you get older and ready to retire, less risks and more conservative.”

Varney asked Rodriguez to break down the core strategy behind these quiet millionaires’ success and he explained, “It really comes down to your behaviors with money, not so much your income… people who don’t even have an outlier salary are still able to build wealth through consistent habits and investing into the market…”

Another story comes from a married couple Rodriguez interviewed, ordinary, practical people who began investing the moment they started building a life together. When Rodriguez asked how long they had been investing, the husband said, “Since we got married,” adding, “Prior to kids, I think I had a 529 plan before they were born.” Their investment approach avoids trendy bets, a point the husband made clear when he explained what they choose to buy: “A diversified equity portfolio. Don’t put fifty percent of your money in Nvidia.” And when discussing their lifestyle, the wife summed it up simply, “I consider myself frugal. Not cheap, but frugal.” Nothing about their approach screams overnight success. It is steady and thoughtful.

A third couple revealed a very different beginning. They started their adult life buried under debt from a mortgage, college loans and a car payment. Over time, with patience and discipline, they dug themselves out, eventually sharing, “We’re debt free for a long time now.”

Their path shows that financial success is not reserved for people starting from a clean slate, it’s accessible even to those who begin deep in debt.

Rodriguez reflects on these interviews alongside his own background as the son of first-generation Filipino immigrants. He emphasizes that the true differentiator in wealth-building is not an extraordinary income or rare opportunities, but behavior. Consistent contributions, disciplined decisions and long-term commitment are what matters in the end.

Later in the interview Varney offered his own perspective on building wealth, which led Rodriguez to respond, “…Starting young, that’s really the key… time in the market is more important than timing the market.”

These stories may feel old-fashioned in an era where instant wins and viral success is the norm, but the data backs them up. The number of millionaires worldwide is climbing, and it is not because of luck. Everyday households have spent years letting compound interest quietly work in the background. With millions joining the millionaire ranks worldwide and hundreds of thousands more added each year in the U.S., Rodriguez’s interviews point to a simple truth: the rise isn’t fueled by flash, but by people who built wealth slowly, steadily and consistently over decades. According to a 2025 update from UBS, the U.S. added more than 379,000 new millionaires in 2024 alone. This averages to over 1,000 new millionaires per day.

This may clarify why Rodriguez’s ‘quiet millionaires’ attract interest: their examples highlight links between everyday financial decisions and long-term wealth outcomes.

Read the full article here