Several years ago, my husband paid for a pizza entirely in change. It wasn’t that he didn’t have any money left at the end of the week; on the contrary, he had just deposited his paycheck in the bank that evening. He simply wanted to use his change and save his bills. Had I been along, I might have been a bit embarrassed to see him counting out his quarters and dimes, but the pizza shop clerk didn’t seem to mind. In fact, he expressed sympathy with another young man who appeared to be just barely scraping by.

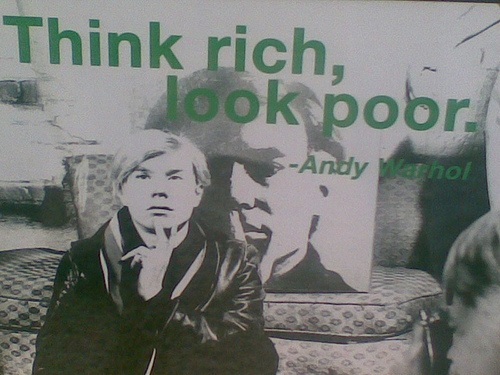

My embarrassment over counting out so much change comes more from holding up those behind me in line than from appearing cheap. (I don’t worry nearly as much about appearing cheap as many people do.) I am, however, often aware of the reactions of those around me when I act frugally in public. The assumptions others make about my frugality — usually that I have much less money than I actually do — can be a benefit to me. Here are some of the ways:

Appearing Poor Makes Is Easier To Negotiate

Even those who are not pinching pennies know that it’s wise to dress down when shopping for a car. Appearing too rich can make the prices go up in a bargaining situation. In fact, appearing poor can help you negotiate as a buyer — if the seller thinks you can’t afford much more than the lowest price he’s willing to give, he is likely to offer you that price rather than lose the deal.

Appearing Poor Means More Freebies

Sometimes, people who observe my family’s frugal habits take pity on us and offer us freebies. I think that might be what happened recently, when a couple at a neighboring table at a fast food restaurant offered us a kids’ meal toy after seeing our family of four share two sandwiches, six pieces of chicken nuggets, and a large cola among us. We had based our order on the typical appetite of our children and a desire not to waste much money on overpriced drinks or kids’ meals, but it probably looked like we had cleared out our wallets to pay for the meal. Others might have been embarrassed to appear unable to afford kids’ meals for their children, but the knowledge that we were saving money to benefit them in the future outweighed any fear of looking poor or cheap.

Savings Habits That Make You Look Poor Can Backfire

Occasionally, appearing poor can backfire, with salespeople ignoring you completely. However, it can be very satisfying to see a good salesperson earn a big commission from your purchase right after someone else snubs you. My husband and I chose our realtor at home show because he took the time to talk with us, even though we appeared too young to have saved enough for a down payment on a house. I sometimes wish that the realtor in the neighboring booth, who dismissed our initial questions to talk with a wealthier-looking prospect, could have seen us signing closing papers on a mid-priced house shortly thereafter.

Frugal Habits Help You Build Rapport With Others

Like my husband getting sympathy from the pizza clerk, I can use my frugal habits to build rapport with others who like to save money, no matter how much they have in the bank. Whether it’s someone behind a counter who offers me a special deal that she knows a frugal person would appreciate or a fellow shopper who is eager to pass on news of other bargains in the area, like-minded savers are good acquaintances to make.

Though I don’t act poor or play up my money saving habits just to get sympathy from others, I am not offended if someone offers me a lower price or a freebie as “charity.” After all, I can never be really sure that the motive was anything other than simple generosity. If I do receive a bargain out of pity, I graciously accept the gift as an act of kindness, and when I am able, I do a favor for someone else, as well.

Image courtesy of gordasm.

Read More

Yes, You Can Save A Bundle with the 365 Day Money Challenge

Here Are 38 Ways To Make Money On The Side You Don’t Know About

Here Are 17 Bills In Your Wallet Worth More Than Face Value

Read the full article here