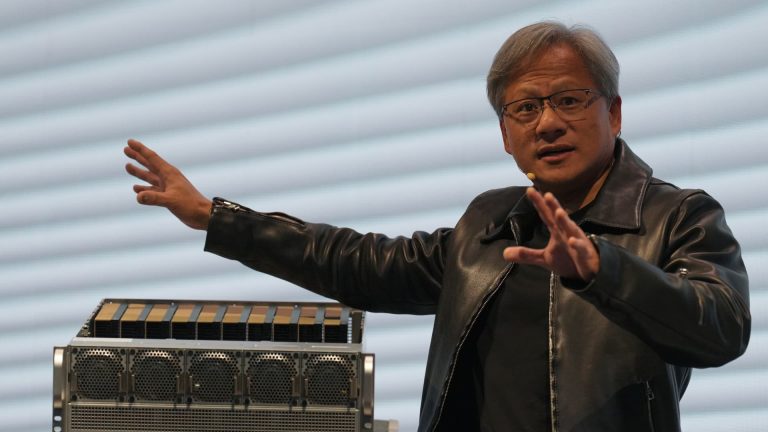

Good news for investors in Big Tech: The back half of this year is looking even better than the first. A review of analyst estimates for our mega-cap tech stocks — Nvidia (NVDA), Amazon (AMZN), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOGL) and Apple (AAPL) — shows strong earnings growth through the end of 2023. Collectively, these six long-term holdings are expected to boost profits by 87% in the second half, up from 27% in the first half, according to estimates from FactSet. Much of that optimism is driven by the market’s excitement with generative AI. But there are other factors at play, including better cost management, growth in key markets like the cloud and data center, and just plain innovation. And while all of these tech stocks have had big rallies this year, there’s likely still room to run. Consider: Based on calendar year 2024 earnings estimates, all six are trading at levels that are in line with their five-year forward price-to-earnings multiples. “We’re optimistic there could be further upside in the back half of the year based on their earnings potential and not simply multiple expansion,” said Zev Fima, portfolio analyst for the Investing Club. Here then are our six mega-cap tech stocks, ranked by the combined earnings growth rate for the upcoming two quarters (versus the year-ago period) — along with reasons for all the enthusiasm. Nvidia 1st half earnings growth: 103% 2nd half expected earnings growth: 371% Investor excitement in Nvidia, already high, was lifted even further by the company’s recently reported fiscal second quarter , which blew expectations out of the park. The chipmaker is benefiting from companies across industries racing to adopt generative AI using Nvidia’s state-of-the-art infrastructure. During the quarter, Nvidia saw massive demand from cloud service providers, enterprise IT and software providers for its NVIDIA H100 graphic processing units that power AI workloads. The exceptional results show Nvidia’s product pipeline “generally points to several quarters of demand,” according to Morgan Stanley’s post-earnings analysis. The firm expects double-digit growth on a sequential basis in the next several quarters “but our numbers could still be conservative,” the analysts wrote. They have an overweight rating on NVDA shares and a $630 price target on the stock. Amazon 1st half earnings growth: 266% 2nd half expected earnings growth: 297% The company’s second quarter North America segment posted an operating margin of 3.9%, impressing investors like us with a 620-basis-point improvement over the last five quarters. By consolidating its fulfillment network, Amazon was able to achieve a 20% reduction in the number of delivery touchpoints, a 19% reduction in miles traveled for deliveries and a 10% increase in deliveries within its eight regional networks of U.S. fulfillment centers. These changes allowed the e-commerce giant to improve shipping and fulfillment costs and led to better inventory placement. Wall Street was also encouraged to see the revenue growth rate at AWS, the company’s cloud unit, stabilize during the quarter, delivering 12% year-over-year growth, to $22.1 billion. Wedbush said Amazon is “well-positioned over the next 18 months as AWS growth has stabilized and is poised to reaccelerate in 2H23 and into 2024.” The research firm has an outperform rating on AMZN shares and a price target of $180. Meta Platforms 1st half earnings growth: 0% 2nd half expected earning growth: 145% Meta’s new AI capabilities “could lead to new drivers of multiyear engagement and/or monetization growth,” Morgan Stanley said in a recent research note. Indeed, strong platform engagement and improved monetization were the two big themes of the social media company’s second quarter , in which revenue increased 11% year over year, to $32 billion. The use of AI improves recommendation systems to keep users on its apps longer, and to better serve ads. Its short-form video offering Reels also had impressive performance, with the annual revenue run-rate across both Facebook and Instagram now exceeding $10 billion, up from $3 billion last fall. Analysts are looking forward to Meta Connect , a two-day virtual event set for Sept. 27 and 28 that will explore the company’s future plans in AI. Management expects third-quarter revenue to be in the range of $32 billion to $34.5 billion. At the mid-point of the guide, that represents 20% year-over-year growth. Morgan Stanley has a outperform rating on META shares. Alphabet 1st half earnings growth: 7% 2nd half expected earning growth: 45% Worldwide digital ad spend is expected to accelerate through the second half of this year and 2024, Wedbush wrote in a recent note, and Alphabet “is in a leading position to capture a larger share of this advertising demand.” During Alphabet’s second-quarter webcast, management called out Google AI, retail and YouTube as three key priority areas that represent “clear opportunities for advertising growth.” Wedbush has an outperform rating on GOOGL shares with a $160 price target on the stock. Bank of America also likes GOOGL stock for search revenue acceleration and year-over-year margin improvement in the second half of 2023, according to a Monday note. The firm also sees an opportunity to scale cloud revenues from $33 billion in 2023 to $50 billion by 2025 while growing margins from 5% to 10%, adding $3.5 billion in profit. BoA has a buy rating on GOOGL and a price objective of $146. Microsoft 1st half earnings growth: 16% 2nd half expected earning growth: 13% In its most recent quarter, management said it will ramp up investment to support Microsoft Cloud growth and demand for AI services in the coming quarters to meet customer demand. That’s why earnings growth for the second half of 2023 looks lighter than the recently reported fiscal fourth quarter of 2023 . Still, earnings are expected to grow at a steady clip in first and second quarters of 2024. And that capex is putting money to work to keep up with Azure and generative AI demand — a positive for future growth. Oppenheimer believes Microsoft’s cloud business is in its “early innings” as its work in artificial intelligence increases its addressable market opportunity and the rate of adoption. The company’s analysts are also bullish on Microsoft’s recently expanded cybersecurity offerings. Oppenheimer has an outperform rating on MSFT shares and a price target of $410 on the stock. Apple 1st half earnings growth: 2% 2nd half expected earning growth: 11% The iPhone maker had a “muted start” to the second half as consumers wait for the September release of the iPhone 15, said analysts at Loop Capital. But any iPhone weakness could be offset by strong services revenue, which reached an all-time revenue record of $21.2 billion in the company’s recently reported third quarter . That was driven by more than $1 billion paid subscriptions. Management expects its services categories to further improve into September and beyond. Morgan Stanley added that Apple’s current quarter will benefit from stronger gross margins which are “likely to reach a third conservative all-time record.” The firm is keeping an overweight rating on AAPL shares and a $215 price target. (Jim Cramer’s Charitable Trust is long NVDA, AMZN, MSFT, META, GOOGL, AAPL. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Good news for investors in Big Tech: The back half of this year is looking even better than the first.

Read the full article here