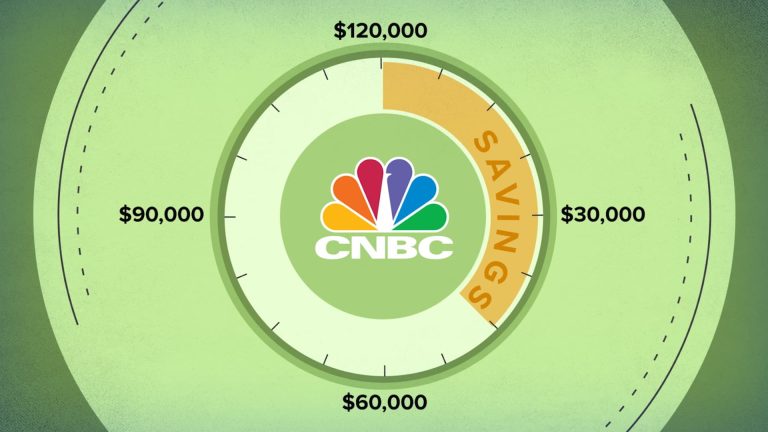

If you’re making $120,000 per year, saving $1 million for retirement might seem out of reach. But with a little dedication and the right timing, it’s certainly possible — if you stick to a clear plan.

As a rule of thumb, most financial advisors suggest that you save 10% to 15% of your salary for retirement. But if your goal is to get to $1 million, the percentage you need to invest will vary drastically depending on how old you are when you start investing.

CNBC crunched the numbers, and we can tell you how much of your income you’ll want to tuck away if you make $120,000 per year.

More from Personal Finance:

60% of Americans are still living paycheck to paycheck

Today’s graduates make less than their parents

Only 19% of Americans increased emergency savings in 2023

These numbers assume that you plan to retire at age 65 and have no money in savings now.

Financial advisors typically recommend the mix of investments in your portfolio shift gradually to become more conservative as you approach retirement. For investing, we assume an average annual 6% return. We don’t take into account inflation, taxes, pay increases or other savings-affecting factors life may throw your way, so make sure you plan accordingly.

Watch the video above to learn how much you should be saving to reach your goal.

Read the full article here