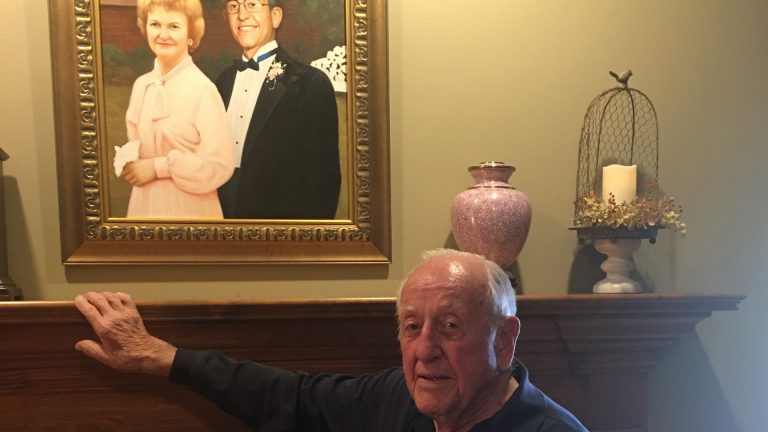

Every morning, Bill Stovall wakes up at around 8:30 a.m. The first thing he does is speak to his wife’s ashes, which are in a pink urn on his fireplace mantle. He keeps it brief. “I say: ‘Good morning. I miss you and I love you. I hope you have a good day,'” said Stovall, who is 100.

Living for an entire century brings challenges. In addition to the death of his wife, Martha, in 2022, Stovall has lost nearly all of his friends. The days at his house in Cumming, Georgia, can get lonely. He’s survived colon cancer and skin cancer. He’s now deaf.

But one subject that doesn’t cause him much stress is money. His nest egg is still around $1 million.

“I always lived within my means,” Stovall said. “I’m not a gambler.”

A lifetime of prudence

Like most stories with a happy ending, along the way Stovall benefited from good luck and privilege. But he also credits his healthy savings to a lifetime of prudence.

Before he retired at 65, Stovall worked for almost half a century in the steel industry, including almost 30 years with LBFoster. He’s held many titles: sales manager, marketing manager, property manager.

“Middle management make all the money for the executives,” Stovall joked. Before his professional career, he served in World War II, as a master sergeant in Belém, Brazil.

Although his salary never exceeded $40,000, he consistently saved 2% of his income a year for retirement. He usually got that share matched by his employer.

“That compounded over the years,” he said.

Just as he stayed in the same line of work throughout his career, Stovall didn’t change houses a lot, either.

In 1957, he bought a brick ranch in Atlanta that didn’t have air conditioning for around $16,000. At the time, he had already been married to Martha for two years, and they had two children: a daughter, Kaye, and son, Art. Around a decade later, when the company he worked for moved to a new location, Stovall sold that house for $22,000.

By then, he and Martha had two more children — twins Toni and Robert, and they purchased a larger place in Duluth, Georgia. The five-bedroom house cost him $45,000. They lived there for more than 50 years. During the Covid-19 pandemic, Stovall sold the house for around $350,000. The only debts he ever took on, he said, were for his mortgages.

Stovall was in his sixties when his father died. He and his brother inherited two properties, and Stovall put the money he made right into his savings.

Stovall’s nest egg is divided between stocks and cash.

“I’m heavily loaded with cash,” he said. “That’s what you survive on.” His monthly Social Security benefit is $2,200 and any additional funds he draws on come from his cash accounts, leaving his stock holdings untouched.

Few expenses but still frugal

Today, he lives in a house on a 40-acre property owned by his daughter, Toni, and son-in-law, Charles, in Cumming. Charles had had a difficult childhood and Stovall let him move in with the family when he was in high school. He and Toni fell in love in their teens. Because Stovall lives on his daughter’s property, he has few housing expenses.

Still, he looks for discounts at the grocery store, and the cheaper dishes on restaurant menus. His children have to push him to replace his tattered shirts and ripped jeans.

After he speaks to Martha’s ashes in the morning, Stovall makes himself breakfast. This is one place he doesn’t hold back. He cooks himself eggs, sausages and biscuits, or pancakes and waffles.

He enjoys monitoring the stock market throughout the day, but he rarely buys or sells individual stocks.

“I’m more of an observer today than a trader,” he said. “The stock market is a crap shoot.”

A few evenings a week, he treats himself to a cocktail. He loves Barton Vodka and Jim Beam. He rarely pours a second glass.

Before bed, he speaks one more time to Martha, who died at 96 of old age. They were together for 72 years. “I say, “I love you. Goodnight.'”

Read the full article here