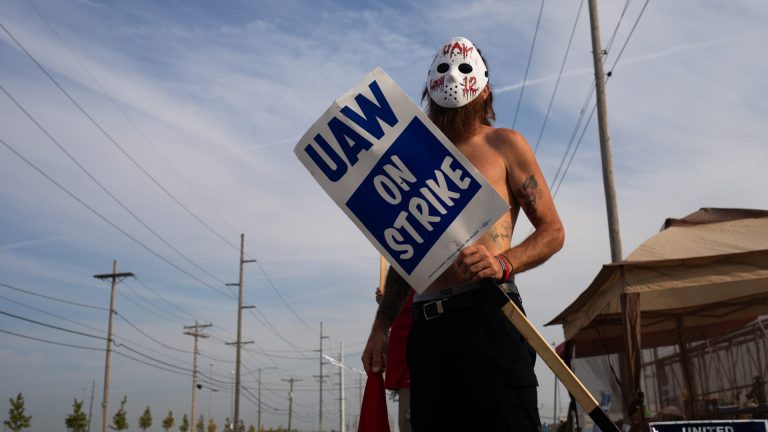

It was another downer of a week on Wall Street with all three major averages posting steep losses despite a bounce back on Friday. The S & P 500 and the technology-heavy Nasdaq fell 2.3% and 2.9% this week, respectively, while the Dow Jones Industrial Average lost 1.5%. There are plenty of reasons why investors are selling stocks. Jim Cramer identified six on the Thursday’s “Mad Money”: High interest rates: This means better risk-free returns in the bond market and a lower present value for stocks. Macroeconomic weakness: This includes worries about the health of consumers. Fear of giving up gains: Money managers are likely locking in gains by selling year-to-date top performers heading into the fourth quarter. Federal Reserve: The central bank signaled this week that it was planning to keep rates higher for longer to beat down inflation. Political climate: A showdown between the Republican-controlled House and Democratic-led Senate over spending could lead to a government shutdown. Strikes: The UAW strikes against the Big 3 U.S. carmakers threatens not just the auto sector but entire ecosystem that supports it. The good news: Not much of this is really news. Rates have been high all year, but that hasn’t stopped technology stocks from ripping higher. Recession concerns? Also old hat. The Fed hasn’t really changed its tune. Stalemate in D.C. is the norm. We’re closely monitoring the United Auto Workers union strike. On Friday, the union said it is expanding strikes to 38 part and distribution locations across 20 states targeting General Motors (GM) and Stellantis (STLA), and that it will not initiate further strikers at Club holding Ford Motor (F) since it is serious about reaching a deal. However, we believe the impact of these strikes will be limited, and that artificial intelligence can help these companies offset higher wages and improve productivity. We view fund managers booking profits as a gift to individual investors, who can purchase high-quality companies at lower prices. As Jim stressed at our monthly meeting Thursday, we must be ready for the burst in stocks we historically get when the Fed wins its fight against inflation. “We need to be buying, not selling, because there are plenty of companies doing well despite the Fed and it is our job to find them before the cycle ends so we do not miss the move up that almost always occurs,” Cramer said. Indeed, late Friday we bought 50 shares of Stanley Black & Decker (SWK). Jim Cramer’s Charitable Trust now owns 625 shares of SWK, which increases its weighting in the portfolio to 1.87% from 1.72%. On tap for next week: Several important macroeconomic updates and a few key company events. Economic releases : The August new home sales report lands on Tuesday and the pending home sales report on Thursday. Both are important, since affordability remains under immense pressure as mortgage rates are at the highest levels in over two decades and list prices are holding firm. Sticky housing prices are also a key watch item for the Fed as it decides the future path for interest rates. However, the most important report is the personal spending and income report, which is out Friday and includes the Fed’s preferred measure of inflation, the core PCE price index. We’re looking for any signs that inflation is continuing to moderate. The Fed has guided for rates to stay higher for longer, but we know it is the data that will ultimately dictate the central bank’s actions — as it should. Earnings : Club name Costco (COST) reports on Tuesday after the closing bell. Few surprises are expected since Costco discloses sales data monthly. However, we will hone in on what management has to say about the sales mix, traffic trends and input cost dynamics. All of these data points help better inform our view of the consumer’s health and prioritization of spending. Meta’s big event : Key holding Meta Platforms (META) will hold its annual Connect conference next week on Sept. 27 and 28. The virtual event will focus on artificial intelligence and virtual/mixed/augmented realities. Members can attend the event . Analysts at Citi on Friday opened a “90-day positive catalyst watch” on Meta shares. The call is meant to capture both the Connect event and earnings coming in late October as the analysts said recent tracking updates show Meta is taking share of the broader online advertising market. Here’s the full rundown of all the important domestic data in the week ahead. Monday, September 25 Before the bell: THOR Industries (THO) Tuesday, September 26 10 a.m. ET: New home sales Before the bell: Cintas Corp (CTAS), Ferguson (FERG), TD SYNNEX (SNX), United Natural Foods (UNFI) After the bell: Costco (COST), MillerKnoll (MLKN) Wednesday, September 27 8:30 p.m. ET: Durable goods Before the bell: Paychex (PAYX) After the bell: Micron Tech (MU), Concentrix Corp (CNXC), HB Fuller (FUL), Worthington (WOR) Thursday, September 27 8:30 a.m. ET: Initial jobless claims 8:30 a.m. ET: Gross domestic product index 10 a.m. ET: Pending home sales Before the bell: Accenture (CAN), CarMax (KMX), Jabil (JBL) After the bell: Nike (NKE), BlackBerry (BB), Vail Resorts (MTN) Friday, September 29 8:30 a.m. ET: Personal consumption expenditure Before the bell: Carnival (CCL) (See here for a full list of the stocks Jim Cramer’s Charitable Trust is long.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

It was another downer of a week on Wall Street with all three major averages posting steep losses despite a bounce back on Friday. The S&P 500 and the technology-heavy Nasdaq fell 2.3% and 2.9% this week, respectively, while the Dow Jones Industrial Average lost 1.5%.

Read the full article here