Federal Reserve Governor Christopher Waller on Wednesday indicated the central bank can afford to hold off on interest rate increases while it watches progress unfold in its efforts to bring down inflation.

With the Fed set to meet again in two weeks, Waller said he is weighing recent data points against each other to see whether the central bank is succeeding in bringing down demand and slowing inflation, or if the economy continues to show resilience and pushes harder on prices.

“As of today, it is too soon to tell,” he said in prepared remarks for a speech in London. “Consequently, I believe we can wait, watch and see how the economy evolves before making definitive moves on the path of the policy rate.”

The remarks come a day before Fed Chair Jerome Powell is set to deliver what could be a key policy speech in New York.

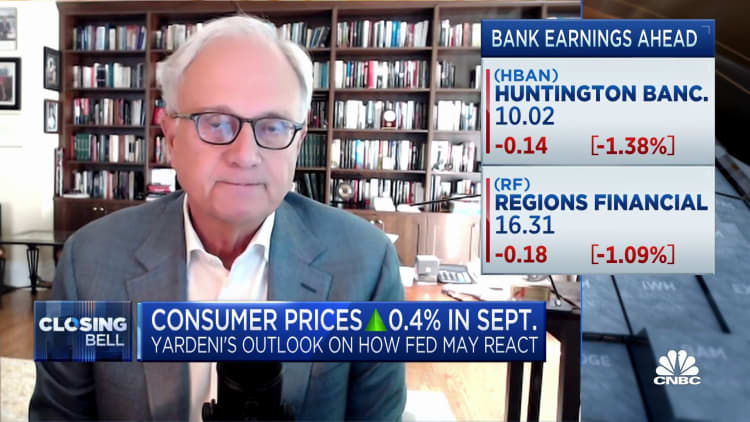

In recent days, multiple Fed officials have said rising Treasury yields are indicative that financial conditions are tightening, possibly making additional rate hikes unnecessary. The 10-year Treasury yield topped 4.9% on Wednesday, a first since 2007.

Indeed, Waller noted the backup in yields and said economic reports over the past several months have been “overwhelmingly positive” regarding inflation. Widely watched indicators such as the consumer price index and the Fed’s preferred personal consumption expenditures price index show rolling core inflation on a three-month basis, respectively at 3.1% and 2%, he noted.

However, officials are wary of head fakes on inflation that have confounded past policy decisions. Few if any Fed officials see rate cuts in the future, but many are leaning toward the idea that the current hiking cycle could be over.

Waller has been one of the more hawkish Fed officials, meaning he favors higher rates and tighter policy. As a governor, he automatically gets a vote on the rate-setting Federal Open Market Committee. His remarks pointed to a near-term halt, without a commitment beyond that.

“Should the real side of the economy soften, we will have more room to wait on any further rate hikes and let the recent run-up on longer-term rates do some of our work,” he said. “But if the real economy continues showing underlying strength and inflation appears to stabilize or reaccelerate, more policy tightening is likely needed despite the recent run up in longer term rates.”

Recent economic reports showed a strong labor market, with nonfarm payrolls rising by 336,000 in September. A Commerce Department report Tuesday showed robust retail spending up 0.7% in September, outpacing inflation and Wall Street estimates.

Waller said he will be watching that data as well as figures on nonresidential investment such as factories, as well as construction spending and next week’s first look at third-quarter gross domestic product growth.

Don’t miss these CNBC PRO stories:

Read the full article here