The S&P 500 and Nasdaq Composite slumped Friday for a fourth straight session, and notched their worst weeks since March, as traders seemed to book profits following the latest corporate earnings releases and U.S. jobs data.

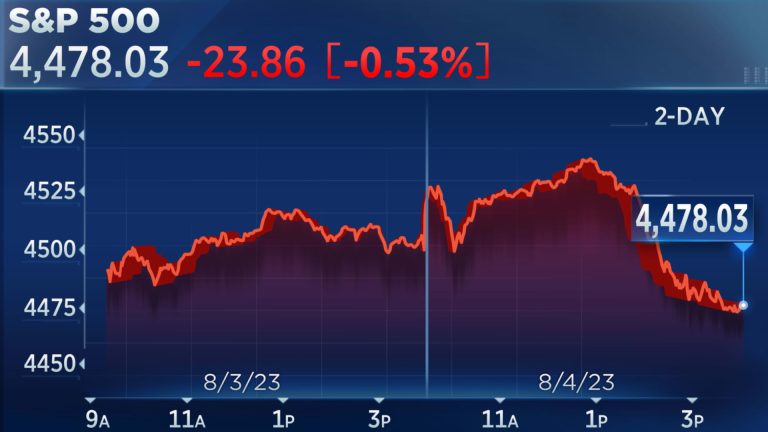

The S&P 500 shed 0.53% to finish at 4,478.03, while the Nasdaq Composite dipped 0.36% to settle at 13,909.24. The Dow Jones Industrial Average lost 150.27 points, or 0.43%, to end at 35,065.62.

All the major indexes reversed earlier gains during afternoon trading, and finished the week with losses. The Nasdaq and S&P dropped about 2.9% and 2.3%, respectively, to notch their worst weeks since March. The Dow edged down 1.1%.

“People this week seem more respectful of risk than they were before,” said Steve Sosnick, chief strategist at Interactive Brokers, adding that “lots of bears have been capitulating, which is often a sign that we’re closer to the end of a rally than the beginning.”

After being lower on the day, the Cboe Volatility Index (VIX) rose to trade above 16 — pointing to investors adding volatility protection.

Friday marked the final day of what’s been the busiest week of second-quarter earnings season. Amazon jumped 8.3% to its highest level in nearly a year after trouncing expectations on profit and offering positive guidance. Apple lost 4.8% after reporting lower revenue than the year-ago quarter. Both tech giants reported results late Thursday.

In a sign of the boom in travel and services demand, Booking Holdings gained 7.9% on stronger-than-expected results. Amgen popped 5.5% on solid earnings and a boosted guidance.

Earnings reports this season for the quarter ended in June have continued to surprise some Wall Street analysts as the expected slowdown in profits proves less than feared. About 84% of S&P 500 companies have given results, with 80% surpassing Wall Street expectations, according to FactSet.

The 10-year Treasury yield also pulled back from a multimonth high to 4.04%. Its rise in recent sessions had pressured risk assets.

A cooler jobs report

Investors also received more clues into the state of the labor market with Friday’s payrolls report. The data showed 187,000 jobs added in July, less than the 200,000 expected by economists polled by Dow Jones. The unemployment rate also ticked lower to 3.5% from 3.6%.

Despite the cooler headline numbers, average hourly wages pointed toward more inflation and came in ahead of expectations, rising 0.4% for the month, and 4.4% on an annualized basis. That came in slightly ahead of the 0.3% and 4.2% expected, respectively.

Many on Wall Street had been eagerly awaiting the jobs report and its implications for the Federal Reserve’s rate-hiking cycle. About 88% of traders expect the central bank to hold rates steady at its next meeting in September, according to CME Group’s FedWatch tool.

But next week’s consumer price report for July could make an even greater impact on rate expectations, said Wells Fargo’s Christopher Harvey.

“A hotter-than-expected print is one of the few things that could really start to change the market’s perception of the Fed, and maybe the Fed’s perception as well,” he said. “But today’s job number, I don’t think does much of anything. I think it solidifies people’s view that the Fed is done at this point.”

— CNBC’s Fred Imbert contributed reporting

Lee este artículo en español aquí.

Read the full article here